Jeff Pabst, CRC

UPDATED MARCH 2020

As you may already know, your Member Annual Statement is now available!

If someone were to tell me we could only have one printed publication for members going forward, I would choose the Member Annual Statement. Your statement is packed with information about your LAGERS benefit and about how your benefit is going to help you achieve financial independence in the future. Let me break down a couple of key sections for you.

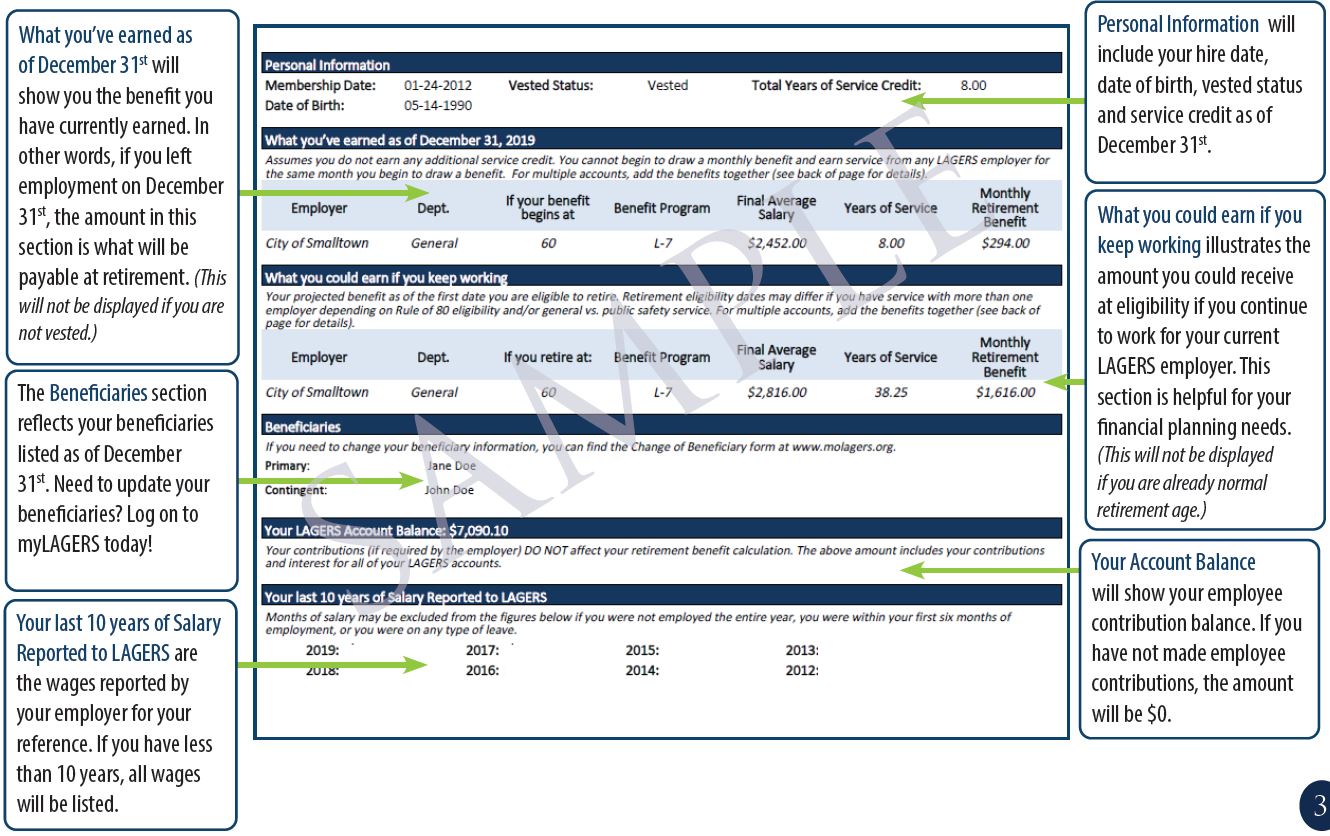

Personal Information

I believe the single most important part of the personal information section is vested status. If it says vested, this simply means you are guaranteed to receive a financial benefit from LAGERS. To become vested, you must earn 60 months of service credit within the LAGERS system. The other information within this section should be reviewed for accuracy.

What you’ve earned as of December 31, 2019

This section is a good planning tool if you plan to leave public service soon and delay your benefit to a later date. The amount(s) shown in this section is the current value of your benefit if you were to terminate employment (as of December 31st). The amount will be payable to you for the rest of your life once you reach eligibility.

What you could earn if you keep working

This portion of your annual statement is the best for financial planning if you plan to continue in public service until you’re able to draw your benefit. In other words, this is a projection of your benefit as if you work until you are eligible to draw your LAGERS benefit. So, since you know your projected amount from your annual statement, you can account for it when determining how much to save for your future income needs.

Keep in mind, this amount can fluctuate if your salary changes.

Beneficiaries

This is the person(s) you have listed as your beneficiary. If this needs to be updated, you can use your myLAGERS account or download the form.

Keep in mind, this person is not necessarily the person who will be payable for a monthly LAGERS benefit. Beneficiaries listed at LAGERS will receive a refund of your contributions if you do not have a surviving spouse of at least two years or dependent children. For more information about LAGERS survivor benefits, click here.

Your last 10 Years of Salary Reported to LAGERS

This section shows you the last 10 years of wages reported to LAGERS by your employer. This is important because your benefit is calculated by multiplying your employer’s multiplier, your average salary, and your service credit together. The average salary component of your benefit looks at your last 10 year of LAGERS credited service and uses either the highest consecutive 5 or 3 years. Whether it is a 3 or 5 year average is determined by your employer.

So, take a look at your annual statement and get a better understanding of just how valuable your LAGERS benefit is. It is going to be your foundation for any of your other financial plans. If you have any questions about your statement, please feel free to reach out.

Phone: 1-800-447-4334

Email: info@molagers.org

Facebook; facebook.com/MissouriLAGERS