Cost of Living Adjustments

Missouri state law provides for an annual cost of living adjustment for all eligible LAGERS retirees. LAGERS’ cost of living adjustments (COLAs) may be given each year on Oct. 1 to all eligible retirees.

The purpose of these adjustments is to ensure that all LAGERS retirees continue to have full purchasing power with their LAGERS benefit as the cost of living fluctuates from year to year.

LAGERS’ Cost of Living Adjustments are:

- Based on the Consumer Price Index (CPI)

- Given at the discretion of the LAGERS’ Board of Trustees annually

- Cannot exceed 4% in a given year

- Cumulative

Why did I not receive an adjustment this year?

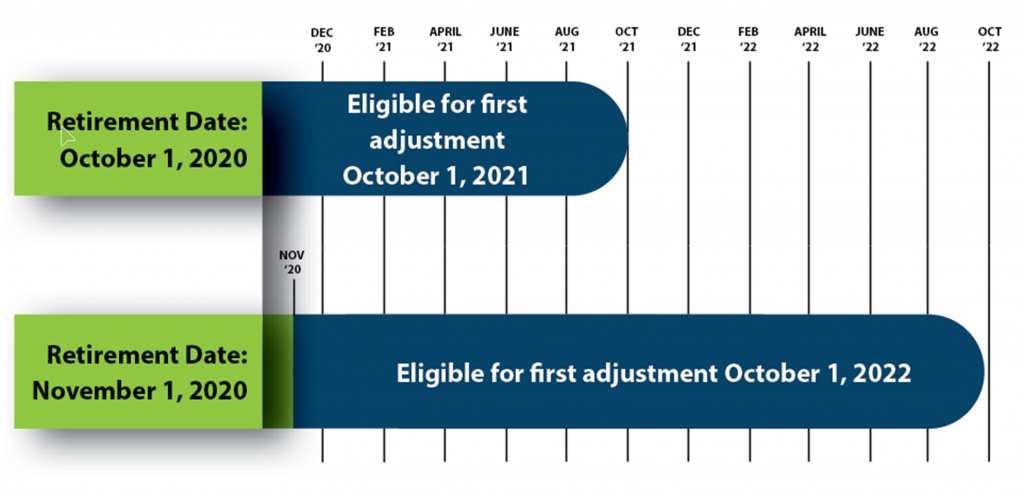

- You may not yet be eligible. To be eligible for your first cost of living adjustment, you must be retired for a full 12 consecutive months, including an Oct. 1. For example, if you retired on Nov. 1, 2020, you would not receive your first adjustment until Oct. 1, 2022.

- Inflation might have been negative. Because LAGERS Board bases the adjustments on the CPI, in years of deflation, instead of decreasing benefits, the board awards no change.

- While LAGERS Board of Trustees strives to ensure the system will be financially able to grant an increase each year, the board is not required by law to do so. If the Trustees feel the system is not in a financial position to pay an increase, they can vote to keep benefit payments level.

Why is my increase different from another LAGERS retiree?

Your COLA is a cumulative figure based on your effective date of retirement. Two members with different effective dates of retirement may receive different increases, but will both ultimately be working toward 100% purchasing power.

In no event will anyone receive greater than a 4% increase in a one-year period as Missouri state law caps annual COLAs at 4%.