Jeff Kempker, CEBS, CRC

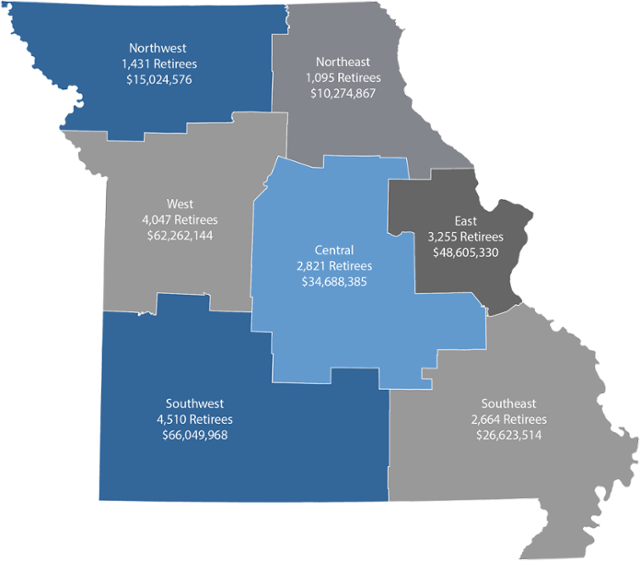

Above: 2016 annual benefits paid to LAGERS’ benefit recipients in Missouri.

Above: 2016 annual benefits paid to LAGERS’ benefit recipients in Missouri.

This post was originally published in November, 2017. For more information on how pensions benefit everyone, go to showmesecurity.molagers.org

DOWNLOAD: LAGERS 2017 Economic Impact Report

Employee benefits are often thought to be for the betterment of one and only one group – the employees. Rather than simply providing a salary, employers use benefits like health insurance, retirement plans, and paid vacation to build morale, keep good workers, and to attract new workers. For these reasons, it makes sense to think that compensation other than salary are good for the employees and only the employees. But there is more to it than that.

A publicly-held company must make decisions that will positively affect the bottom line so the shareholders may profit. Likewise, government leaders serve the taxpayers and make decisions to enhance the prosperity of their communities. Decisions about employee benefits, therefore, cannot only be valuable to the employee, but also must make sense for the shareholder or taxpayer. In other words, all stakeholders must get some return on the investment for employee benefits.

Let’s narrow this topic down and focus on retirement benefits for government employees and how these programs can be beneficial to the taxpayers. LAGERS offers retirement benefits to the local government employees in Missouri, and now serves over 60,000 current and former workers. Government agencies have the option to join LAGERS, which currently has 715 employers participating in the system with around 15 employers signing on each year.

One-in-ten Missourians is a beneficiary of Missouri LAGERS.

LAGERS provides a defined benefit pension plan that pays a retiree a modest, pre-determined amount each month. The amount of the benefit is based on a formula driven by the employee’s years of service and salary. About 75% of state and local government workers in the U.S. are covered by these types of plans.

Government entities continue with defined benefit plans because they help them attract workers to provide valuable services to the taxpayers. Since the amount of the benefit is tied to longevity, defined benefit plans discourage turnover. But, most importantly, defined benefit plans help employees retire when they should. This is good for the employer so they can avoid the additional costs incurred when employees stay on the job too long. All of these advantages of a defined benefit retirement plan are also good for the taxpayers. Taxpayers want well maintained streets, good parks, healthy businesses, and great public safety. These things are a product of well-trained, experienced, and motivated public workers.

LAGERS paid out $283 million in retirement benefits last year. $263 million of that stayed in Missouri.

Another huge benefit that is many times overlooked is the positive economic impact that defined benefit plans have on local communities. Retirees receive monthly lifetime benefits that change only if inflation increases. These benefits are not stuffed under a mattress and forgotten, but spent within their community. Over 90% of LAGERS-participating workers remain living in the same community after retirement. Their retirement benefits are then re-invested in local goods and services.

There are LAGERS retirees living in every county in Missouri and their pension benefits can really add up. LAGERS paid out $283 million to 21,845 benefit recipients last year. $263 million of that stayed in Missouri. That is income these Missourians can depend on every month and helps ensure middle class workers remain middle class during retirement.

DOWNLOAD THE COMPLETE ECONOMIC IMPACT REPORT HERE.

Employee benefits must provide value not only to the employee, but to all stakeholders. Defined benefit pensions help attract good workers, incentivize those workers to stay with their employer during their most productive years, then allow them to retire when they should. During retirement, the steady monthly payments are reinvested in the community to purchase goods and services. For all of these reasons, defined benefit pension plans are a good value for the taxpayers.

Jeff Kempker is the Assistant Executive Director, Member Services at Missouri LAGERS.