Elizabeth Althoff

Update: Effective August 28, 2020, Missouri state law has been amended to expand employers’ options for the employee contribution election from a 0% or 4% employee contribution amount to a 0%, 2%, 4% or 6% employee contribution amount. Click here to learn more.

Saving for retirement is hard. Whether you’re saving for kids’ college, paying for health insurance, making daycare payments or just keeping up with monthly bills, it often feels like by the time your paycheck hits the bank, there’s not much left. It’s easy to understand why for many LAGERS members it’s hard to see another 4% going towards your LAGERS benefit. Although it can feel like a lot of money, keep in mind that your 4% contributions could pay off big some day when it comes to your retirement security. Here’s why:

For many employers, providing a retirement benefit, like LAGERS, is financially not possible without the help of employee contributions to offset some of the cost. For other employers, they may have their employees contribute so that they can provide higher levels of benefits than they otherwise could have. Whatever the reason an employer chooses to have employees contribute to LAGERS, the important thing for members to remember is that their 4% is helping to fund a guaranteed lifetime benefit that will never run out and can never be less than what members pay in: a benefit that you may otherwise not have.

Some financial experts recommend that employees without pension benefits should be saving anywhere between 10%-15% of their salary. And that you should be saving that much consistently every month from the start to end of your career. And on top of that, you should never take any withdrawals from that account until retirement. That’s a pretty tall order for many working Americans, and then forget about trying to figure out how to invest that money wisely so that your nest egg won’t run out in retirement.

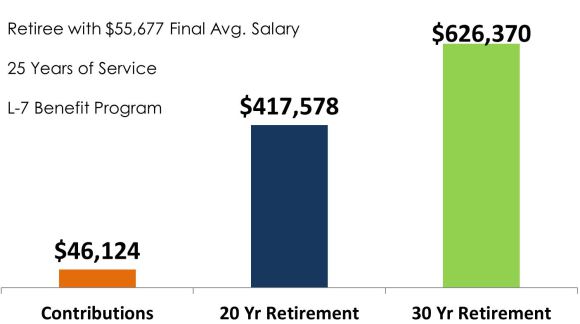

So not only are member contributions a small price to pay in order to have access to a plan, like LAGERS, but better yet, what most members receive back in benefits is tenfold what they themselves paid in. In the following example, we consider an employee who worked for his employer with a middle of the road, L-7, plan for 25 years, and received modest salary increases over that time which produced a final average salary at retirement of just over $55,000 per year. Over that 25 year period, he contributed his 4% to LAGERS each and every month for a total member contribution balance of $46,124 at the end of his career. He retires and begins drawing a modest $1,740 monthly retirement benefit.

While his monthly payment may not feel like a winning lottery ticket, it’s enough along with social security and a little personal savings to help him live comfortably in retirement. But what’s hard to see when we just look at the monthly benefit is how much that benefit is going to add up over the next few decades. Remember that LAGERS is going to pay him every single month for the rest of his life, no matter how long he lives, and no matter what the markets do (or don’t do). If our member retired at age 60, by the time he turns 80, his modest monthly benefit has added up to more than $400,000! That’s a lot of money to come up if you were saving for retirement on your own! Let’s say he lived until 90 years old, the total payout then would be well over $600,000.

When we look at his total lifetime payout, that $46,000 in member contributions now looks like a pretty smart financial investment! And don’t forget on top of that, he could potentially receive cost of living adjustments each year throughout retirement which ensures that his benefit never loses purchasing power over time.

LAGERS benefits provide our members with tremendous security and protection from many of the risks (such as inflation and investment risk) that many retirees will face throughout their retirement. Our members have the peace of mind of knowing that a small investment every month is going to pay off in big ways in the future. And don’t forget that if you ever decide to leave your employer prior to retirement, you are always guaranteed to receive back at least what you paid in, plus interest. If you would like to check out your current contribution balance, visit your myLAGERS account today!