Elizabeth Althoff

Update: Effective August 28, 2020, Missouri state law has been amended to expand employers’ options for the employee contribution election from a 0% or 4% employee contribution amount to a 0%, 2%, 4% or 6% employee contribution amount. Click here to learn more.

If your employer has elected to be employee-contributory in LAGERS, you’ve probably noticed that 4% of pay coming out of your paychecks each month.

In LAGERS, all full time employees who work for a Contributory employer are required to contribute 4% of their gross pay each month to help pay for their future retirement benefit. These member contributions are treated differently than any other contributions your employer makes to LAGERS on your behalf because that 4% is your money! Here’s a quick summary of what you need to know when it comes to your member contributions.

Are My Contributions Guaranteed?

It’s your money, and so you (or your beneficiary) are always guaranteed to receive back at minimum, what you individually paid into LAGERS, plus interest. Every month, your contributions are placed into an account with your name on it, and those funds earn interest (currently at 0.5%). Keep in mind, that unlike a defined contribution plan, such as a 457(b), your contribution balance in LAGERS does not affect how much your monthly benefit will be at retirement because your LAGERS benefit is based on how long you worked, not how much you or your employer paid in. Your member contributions are simply helping to fund your future benefit and most members will receive far more during retirement than what they themselves paid in.

When Can I Withdraw my Contributions?

Although you cannot withdraw or borrow against your contribution balance while working, if you leave employment prior to reaching your early retirement age, you always have the option to apply for a refund of your contributions. However, taking a refund forfeits any service associated with those contributions. If you leave your employer, take a refund of your contributions, and later re-employ somewhere in the LAGERS system; you start over with no credited service (unless you repay your contributions, plus all applicable interest). Members who leave LAGERS covered employment prior to retirement always have the option to leave their contribution balance in LAGERS to preserve their service and future monthly benefit.

How Are My Contributions Taxed?

Your member contributions are made after-tax. This means that you are paying tax on the 4% as it goes into LAGERS, and a portion of your monthly benefit will not be taxable when you receive in back through a monthly benefit.

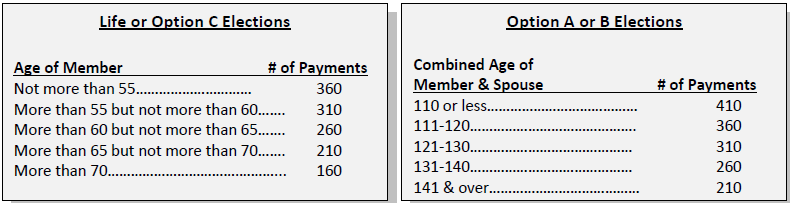

The non-taxable portion of your monthly benefit at retirement is determined by the IRS’ Special Rule method: your total employee contribution balance (excluding interest) divided by a projected number of total payments. The total number of payments is determined using the following tables and is based on your age at retirement and Payout option elected.

For example, if I paid in $25,000 of my own money, retired at age 61, and elected the Life Option, I could estimate my non-taxable monthly amount by taking $25,000/260 payments = $96.15 each month.

Thinking about taking the Partial Lump Sum? Because the PLUS is equivalent to 24 months’ worth of payments, the non-taxable portion of a PLUS distribution would be 24 x your monthly non-taxable amount. If you are rolling your PLUS into a pre-tax retirement account, the non-taxable portion of the benefit will still be paid directly to you.

Your Contributions in Retirement

When you reach retirement and begin drawing a monthly benefit, you receive your contributions back through your monthly benefit payments. Should you pass away in retirement before receiving back at least what you paid in, and if there is no further monthly benefit is payable, LAGERS will refund the remaining contribution balance to your beneficiary. For example, say you have a contribution balance of $25,000, retire electing the Life option, and draw a monthly benefit with payments totaling $12,000 at your death. Since under the Life Option, no further monthly benefit is payable to a beneficiary, LAGERS would refund $13,000 to your beneficiary.

There is a lot to think about when it comes to your member contributions, but most importantly, keep in mind that you are always guaranteed to receive back at least what you paid into LAGERS and those contributions are helping to fund a future guaranteed lifetime benefit! You can view your contribution balance on your Annual Statement that you receive from LAGERS each year or 24/7 on your myLAGERS account.