Jeff Pabst, CRC

It’s times like these where LAGERS strong plan design shines through for the thousands of public servants who rely on LAGERS’ benefits for their financial security. LAGERS provides our retirees with some peace of mind knowing their monthly benefit is going to arrive and provide them with essential income. We take this responsibility to our members and retirees very seriously, and it is shown through the system’s strong plan design. Here are 5 examples of how LAGERS is able to provide stability during times of instability.

-1.png)

1. Member’s Benefits Are Pre-Funded. Each of LAGERS employers pay a portion of their contribution rate for the purposes of pre-funding the assets necessary to pay future retirees’ benefits. Then when someone retires, a one-time transfer is made from the Employer’s “Accumulation Fund” and transferred to the “Benefit Reserve Fund” from which all retiree’s benefits are paid. These pre-funding features ensure that a retiree’s benefit is fully funded before their retirement and monthly payment can be made for the retiree’s lifetime.

-1.png) 2. Long Term Approach to Funding. As part of pension funding, there are a number of assumptions established when calculating the amount needed to properly fund the pension plan. LAGERS examines and may adjust these assumptions at least every 5 years through a data driven process involving LAGERS’ actuary, LAGERS’ staff (with consultation from LAGERS’ external asset managers), and LAGERS’ Board of Trustees. By having an established procedure that allows adjustment at least every 5 years, it puts a process in place that discourages “knee jerk” reactions to the current For example, with the recent fluctuations in the investment environment, the system won’t immediately change its investment return assumption. Instead, when it is time to adjust LAGERS actuarial assumptions in the 5-year cycle, the discussion will be made at that point and will be based on long-term expectations not short-term performance.

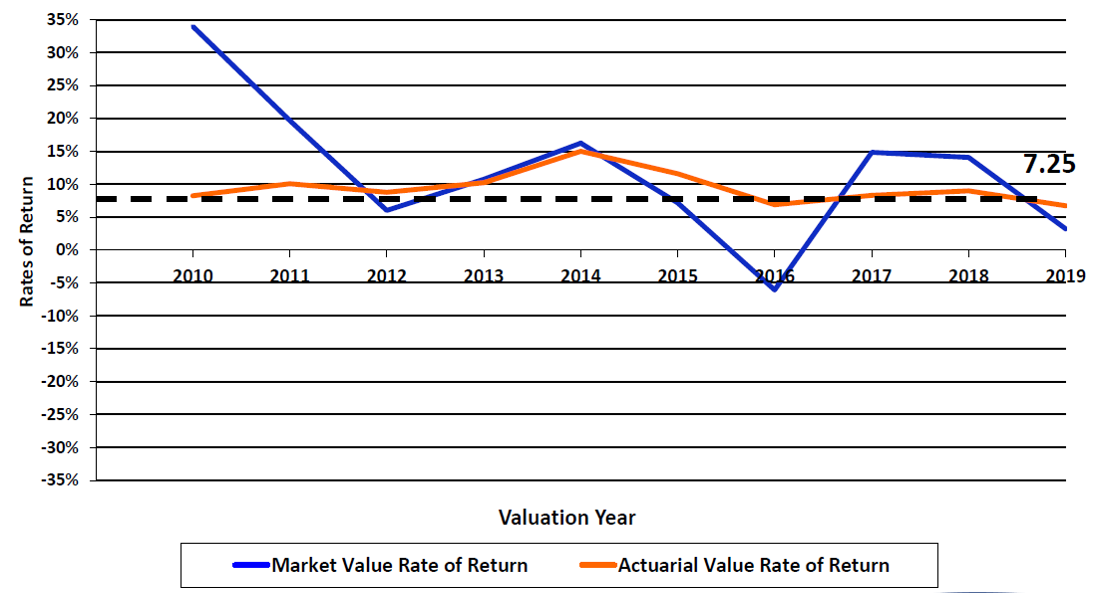

2. Long Term Approach to Funding. As part of pension funding, there are a number of assumptions established when calculating the amount needed to properly fund the pension plan. LAGERS examines and may adjust these assumptions at least every 5 years through a data driven process involving LAGERS’ actuary, LAGERS’ staff (with consultation from LAGERS’ external asset managers), and LAGERS’ Board of Trustees. By having an established procedure that allows adjustment at least every 5 years, it puts a process in place that discourages “knee jerk” reactions to the current For example, with the recent fluctuations in the investment environment, the system won’t immediately change its investment return assumption. Instead, when it is time to adjust LAGERS actuarial assumptions in the 5-year cycle, the discussion will be made at that point and will be based on long-term expectations not short-term performance.

3. Investment Smoothing & Diversification. As you know, the investment markets can be volatile. Because of this uncertainty around the investment markets, the LAGERS system utilizes an investment smoothing mechanism that allows for the change in the markets to be realized over 5 years instead of annually. This creates funding stability and helps limit fluctuations in LAGERS employers’ contribution rates.

Another very important aspect of LAGERS is the overall diversification of our investment portfolio. This diversification provides the system with strong performance with a a pre-determined level investment risk. When constructing the LAGERS investment portfolio, our investment team is constantly working to build a portfolio that can weather any economic environment. Brian Collett, LAGERS Chief Investment Officer, explains, “[It’s] similar to how you build a house for any weather. That fact that it may be raining today has nothing to do with how we are designing the house. We designed the house for any and all weather we may encounter. So we build our portfolio in that sense.”

Another very important aspect of LAGERS is the overall diversification of our investment portfolio. This diversification provides the system with strong performance with a a pre-determined level investment risk. When constructing the LAGERS investment portfolio, our investment team is constantly working to build a portfolio that can weather any economic environment. Brian Collett, LAGERS Chief Investment Officer, explains, “[It’s] similar to how you build a house for any weather. That fact that it may be raining today has nothing to do with how we are designing the house. We designed the house for any and all weather we may encounter. So we build our portfolio in that sense.”

4. Employer Plan Flexibility. Each of LAGERS employers have the flexibility to change their benefit levels to best meet their employee retention goals and budgetary constraints. So, if the environment calls for an employer to change their benefit levels to make it more affordable or more attractive to employees, the employer has the ability to do so.

5. Experienced Professional Staff and a Well-Rounded Board of Trustees. Every time I think about the experience of the LAGERS staff it amazes me. The lion’s share of turnover we have at LA GERS is career employees who are retiring. Additionally, LAGERS Executive Team has over 115 years in total of pension administration experience. This experience plays a vital role in the day-to-day administration of the plan.

GERS is career employees who are retiring. Additionally, LAGERS Executive Team has over 115 years in total of pension administration experience. This experience plays a vital role in the day-to-day administration of the plan.

As well, LAGERS Board of Trustees has a wide range of experience and expertise. The Board includes 3 Member Trustees who are members of the system, 3 Employer Trustees who bring the employer’s perspective to the plan and one Citizen Trustee who is appointed by the Governor. There are several members of the board that have been serving for more than 10 years, and have come from various backgrounds including a Fire Fighter, s elf-employed entrepreneurs, an Assistant City Manager, Public Utility Worker and more. It’s safe to say that the decision making of your system is in experienced and well-rounded hands who consider both the member and the overall sustainability of the LAGERS system when making decisions.

elf-employed entrepreneurs, an Assistant City Manager, Public Utility Worker and more. It’s safe to say that the decision making of your system is in experienced and well-rounded hands who consider both the member and the overall sustainability of the LAGERS system when making decisions.

Right now, stability is something that everyone is seeking. The LAGERS system provides this stability for its retirees, and will continue to do so for our active members through strong plan design, a long-term focus, prudent investments and a dedication to Missouri’s local government workers.