Jeff Kempker, CEBS, CRC

When?

Perhaps the biggest question to answer when planning your retirement is “when?” When is the best month to call it quits? When is the best day? When will I start drawing benefits? When will I start receiving Social Security? When do I need to apply for benefits? When is enough, enough? There are a lot of questions that begin with “when.” Relax. LAGERS can help fill in some of the answers for you.

When is the soonest I can begin to draw my LAGERS retirement benefit?

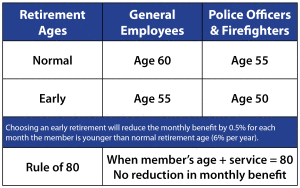

You must have at least five years of LAGERS service and be retirement age to begin drawing your monthly benefits. Also, you cannot begin drawing your benefit while earning service credit from your employer. The age you may choose to begin receiving your monthly payments is different than your Social Security age. The earliest the benefits may begin is when you reach age 55. If you are a police officer or firefighter, benefits may begin even earlier, at age 50. However, choosing to initiate your monthly benefit at the earliest possible age does come with a cost. Age 55 for general employees and 50 for police and fire are LAGERS’ early retirement ages, so the monthly benefit will be reduced by 6% for every year you are younger than your normal retirement age (the actual reduction is 0.5% per month). Normal retirement age is 60 for general employees and 55 for police officers and firefighters.

Some of you reading this may gain access to your monthly benefits even earlier than age 50 or 55, without any reduction, if your employer has chosen to provide the Rule of 80 (AKA, 80 and Out). The Rule of 80 allows eligible employees to begin their monthly benefits when their age + service = 80. For example, a 50-year-old LAGERS member with 30 years of service could begin monthly payments at age 50 with no reduction. Only about one-in-five participating employers provide the Rule of 80 as it does cost more for this option.

When is the best month to retire?

As far as LAGERS is concerned, it doesn’t matter. You may initiate your monthly benefit any month you choose. You receive credit for every month you work in a LAGERS-covered position so you don’t need to worry about working a certain number of months throughout the year to increase your benefit. Your benefit increases every month you work!

The most popular retirement effective date is January 1st. LAGERS sees more members call it quits in December each year with benefits beginning in January than any other month. This doesn’t necessarily mean that this is the best date for you, however. You will definitely want to be aware of any benefits your employer provides that may affect your retirement date. Are there any post-retirement benefits provided by your employer? What about unused sick and/or vacation payouts? Some of these benefits may be better or worse depending on when you leave your job.

The October 1 Myth. There is a myth among LAGERS members that if you retire after October 1st in a given year that you will be missing out and your benefits will forever be less than they should be. This is absolutely false. Don’t believe this myth. I won’t go into the specifics here, but I have written another entire blog about it.

When will my benefits be paid to me?

Once you have made the decision to take the leap into the next chapter in life and all of the paperwork is complete, your LAGERS benefit is always paid on the first of the month for that month. So, if you decide your last day of work will be December 23rd, your retirement effective date (the date you will be paid) will be January 1st. Almost all LAGERS retirees opt for electronic payment of their benefit so they know their payment will be in their bank account on the first banking day of each month.

The partial lump sum is an option retirees may choose if they want some money up-front in addition to their monthly benefit. If you decide the partial lump sum is right for you, this will be paid to you 90 days after your first payment date. You can choose to roll this payment over to another retirement account or extend payment of the partial lump sum out to 150 days if you want to reduce your tax burden. The partial lump sum is a big topic, so we cover it in another blog.

When is enough, enough?

This is a question only you can answer. Believe it or not, there are many benefits to showing up to work every day. It keeps you engaged physically, mentally and socially. But at some point, enough is enough. When all of the financial and emotional planning is done and you have determined you can handle retirement all that’s left is walking up to the edge and making that final jump. When you get to this point, you’ll know.

When? This question can keep us up at night. But we here at LAGERS can help you get at least some answers. The most important answers, however, are up to you.