Jeff Kempker, CEBS, CRC

To take the Partial Lump Sum or to not take the Partial Lump Sum? That is the question.

The Partial Lump Sum, or PLUS, is an option available to LAGERS members at retirement. The PLUS provides a retiree the choice to receive 24 monthly payments up-front, as a lump sum distribution. Retirees choosing the PLUS will receive a reduced monthly benefit for the remainder of their life and that payment will begin immediately. The PLUS can be chosen with any monthly payment option and can be rolled over into another eligible retirement account to delay paying taxes. The monthly benefit is reduced by 16% for a member retiring at age 60.

The alternative to the PLUS is to simply choose to receive the full monthly benefit, without the up-front lump sum payment and without the PLUS reduction.

For example:

Monthly Payment = $1,000

PLUS Amount = $24,000 (Monthly Payment x 24)

Monthly Payment if PLUS is chosen at age 60: $840

How do you know what is right for you? Each individual’s situation is unique and you want to make sure you make the best decision to maximize your retirement benefits. It may seem like the easy choice to opt for the lump sum money, but you may be better off in the long run to choose the higher monthly benefit. Here are some things to consider when deciding whether or not the take the PLUS.

1. How long do you expect to live?

Are you a healthy person? Do you always wear your seatbelt? Does your family have a history of long-lives? These are important questions to ask yourself when thinking about if you should take the PLUS. Why? Because if you live long enough, it may be best to leave the PLUS alone. Some simple math can illustrate this.

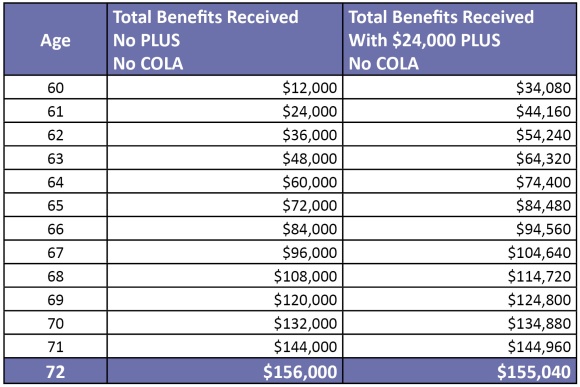

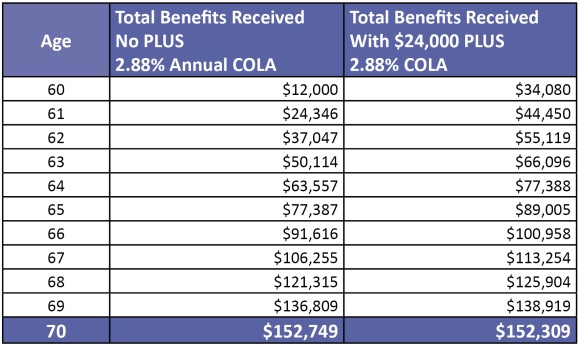

Let’s look at two retirees of identical age and benefit amount. The first retiree chooses to receive a $1,000 monthly benefit and does not choose the PLUS. The second retiree receives a $24,000 PLUS and a monthly benefit of $840. To make things easier, we will also assume no cost of living adjustments on the monthly benefits and that the PLUS amount is not invested so there is no return generated from this money.

As you can see from this chart, choosing the PLUS is advantageous for the first several years in retirement. But look what happens at age 72. The retiree that did not choose the PLUS but opted for a higher monthly benefit actually comes out ahead.

Now let’s look at the same two retirees, only this time we will add in a 2.88% annual cost of living adjustment. Again, the retiree who chose the higher monthly benefit has more money, this time surpassing the retiree who chose the PLUS at age 70.

Obviously, none of us know when we will expire. However, we must at least try to estimate it so we can make the best possible decisions about our retirement income.

2. What do you plan to do with the PLUS?

So you might by thinking, “Wait a minute! I’m going to invest that PLUS and watch my money grow. Then let’s see who ends up with the most money!” Wonderful idea! LAGERS members that wish to put their money to work have the option to directly roll the PLUS into another eligible retirement account.

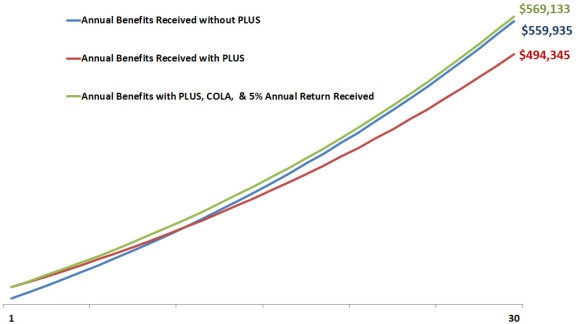

This chart shows the 30-year retirements of three retirees. The green line shows the income for a retiree that chooses to re-invest the PLUS and receives a 5% annual return on that investment. The blue line illustrates the growth of income for a retiree that chooses the full monthly benefit without the PLUS. The red line is the retiree that chooses the PLUS but does not invest the money. Each of these retirees receives an annual 2.88% cost of living adjustment. Here, the retiree that chose to re-invest the PLUS starts out ahead and remains there over the entire 30 year period.

I have heard several LAGERS members say they are choosing the PLUS to pay down debt. This may be a good strategy since it is advantageous to enter retirement debt free. Other members have said they will be using the PLUS to buy a toy, re-model their kitchen, or to take a dream vacation. The main thing to remember about the PLUS is that it is YOUR money. You earned it. You get to decide what is best for you!

3. Do you want to leave a legacy?

Another comment I often hear from members is that LAGERS payment options tend to favor married couples because there are options where payments continue to a spouse after the LAGERS member retiree passes away. Members that wish to leave a legacy to someone other than a spouse may wish to use the PLUS for this purpose. The PLUS can be rolled over into another eligible retirement account or you may receive the money directly. If you choose to receive the money directly, the full PLUS amount will be taxable. Once you have rolled the PLUS over or deposited it into some other account, you can then choose to whom the funds will be paid after your death.

Deciding whether or not to choose the Partial Lump Sum at retirement is an individual choice. It is crucial not to simply pick the largest number on the page and assume that is the best option for you. Thinking about how long you will live, what you will do with the PLUS, and if you want to leave a legacy are all important considerations when making this decision.