Calculating Benefits

LAGERS’ benefits are designed to be a reflection of your working career. The longer you work, the greater your benefits will be. The amount of your benefit will be determined using a simple formula. LAGERS uses the same formula to calculate retirement, disability, and survivor benefits. However, each component of the formula will vary depending on your employer’s benefit choices, your salary, and your length of service. The formula used to calculate LAGERS benefits is below:

There are various benefit multipliers within the LAGERS system called Benefit Programs. Below are examples of each benefit program and the multiplier they provide. The higher the multiplier, the higher your retirement benefits will be.

Life Programs

Life programs provide a permanent benefit each month for your lifetime.

Examples of each life program with income replacement percentages as well as monthly benefit amounts are below.

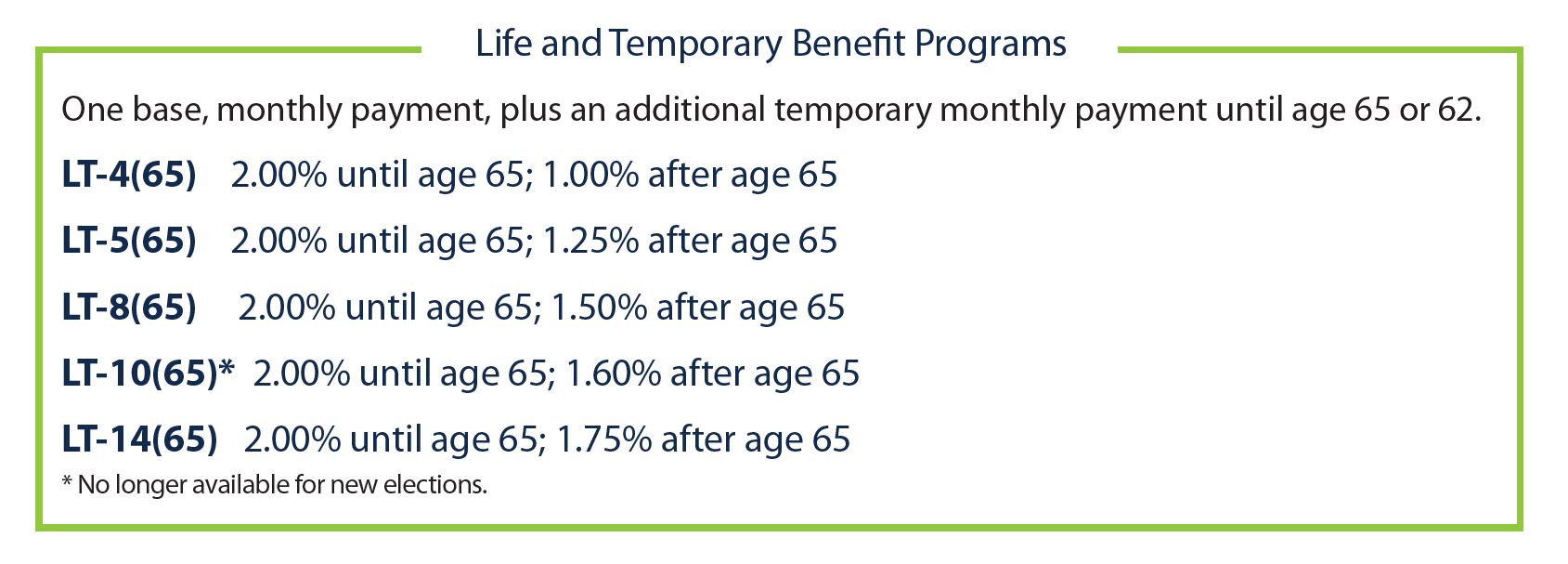

Life & Temporary Programs

Life and Temporary programs provide a permanent base benefit to you every month for your lifetime, plus an additional monthly benefit payable until age 65 or 62

LT Plans Notes:

- The temporary benefit portion is only payable to the member.

- The temporary benefit portion will stop at 65 or 62.

- Leaving LAGERS-covered employment before you are age eligible to retire will result in forfeiture of the temporary payment.

- The temporary benefit portion is not payable on disability or survivor benefits.

Final Average Salary (How Much You Make):

Your “final average salary” is taken into consideration when calculating your benefit. LAGERS will use the average of either your highest consecutive 36 months (3-Years) or 60 months (5-years) of salary from your last 120 months (10-years) of LAGERS credited service. Your employer determines whether your benefit will be calculated using a 3-year or a 5-year final average salary.

For most of you, your final average salary may be your last 36 or 60 months; however, the highest consecutive month period may fall anywhere within your last 120 months of credited service.

Your LAGERS benefit is designed to reward longevity. You earn one month of “Credited Service” for each month you work in a LAGERS covered job. The more service credits you earn, the higher your benefits will be. The time you worked for your employer before it joined LAGERS may also count toward your credited service

Credited service is broken into two types of service: Prior Service and Membership Service.

- Prior Service is credited service you earned prior to your employer joining the LAGERS system. When an employer joins the LAGERS system, they can choose to cover 100%, 75%, 50%, or 25% of their employees’ prior service. If your employer had a retirement plan in place before joining LAGERS, it may not have the option of covering your prior service. If there are portions of your prior service that are not covered by your employer, you may be eligible to purchase that service on your own.

- Membership Service is credited service you earn with your LAGERS employer after it has already joined the LAGERS system. If you have only worked for your employer after it joined the LAGERS system, you will only have membership service.

Below is an example of how credited service is calculated.

Benefit Examples:

L-1

1% x 10 Years = 10% of income replaced

1% x 20 Years = 20%

.01 x $3,000 x 10 = $300 per month

.01 x $3,000 x 20 = $600

L-3

1.25% x 10 Years = 12.5% of income replaced

1.25% x 20 Years = 25%

.0125 x $3,000 x 10 = $375 per month

.0125 x $3,000 x 20 = $750

L-7

1.5% x 10 Years = 15% of income replaced

1.5% x 20 Years = 30%

.015 x $3,000 x 10 = $450 per month

.015 x $3,000 x 20 = $900

L-9*

1.6% x 10 Years = 16% of income replaced

1.6% x 20 Years = 32%

.016 x $3,000 x 10 = $480 per month

.016 x $3,000 x 20 = $960

*The L-9 is no longer open for new elections.

L-12

1.75% x 10 Years = 17.5% of income replaced

1.75% x 20 Years = 35%

.0175 x $3,000 x 10 = $525 per month

.0175 x $3,000 x 20 = $1,050

L-6

2% x 10 Years = 20% of income replaced

2% x 20 Years = 40%

.02 x $3,000 x 10 = $600 per month

.02 x $3,000 x 20 = $1,200

L-11**

2.5% x 10 Years = 25% of income replaced

2.5% x 20 Years = 50%

.025 x $3,000 x 10 = $750 per month

.025 x $3,000 x 20 = $1,500

**The L-11 is only available for non Social Security participating departments.

2% x 20 Years = 40% income replaced until age 65

1% x 20 Years = 20% income replaced after age 60

.02 x 3,000 x 20 = $1,200 per month until age 65

.01 x $3,000 x 20 = $600 per month at age 65

LT-5(65)

2% x 20 Years = 40% income replaced until age 65

1.25% x 20 Years = 25% income replaced at age 65

.02 x 3,000 x 20 = $1,200 per month until age 65

.0125 x $3,000 x 20 = $750 per month at age 65

LT-8(65)

2% x 20 Years = 40% income replaced until age 65

1.5% x 20 Years = 30% income replaced at age 65

.02 x 3,000 x 20 = $1,200 per month until age 65

.015 x $3,000 x 20 = $900 per month at age 65

LT-14(65)

2% x 20 Years = 40% income replaced until age 65

1.75% x 20 Years = 35% income replaced at age 65

.02 x 3,000 x 20 = $1,200 per month until age 65

.0175 x $3,000 x 20 = $1,050 per month at age 65