The Cost of Joining LAGERS

To determine the cost of joining LAGERS, an employer must request an initial valuation. This valuation provides an employer with the actuarially determined cost for the many combinations of benefits available to LAGERS’ employers.

To request an initial valuation, a personnel data form must be requested, completed and returned to LAGERS’ office. Once submitted to LAGERS’ office, it will be forwarded to LAGERS’ actuary for processing. After completion, LAGERS staff will forward to the employer with any additional instructions. LAGERS’ actuary will send the employer an invoice for completion of the valuation.

Initial Actuarial Valuations

An initial valuation will illustrate the cost for an employer to provide LAGERS benefits for its personnel group. The explanation below is a sample.

To request an initial actuarial valuation, an employer must complete a personnel data form for its current employees. The personnel data form must be sent to LAGERS along with any previous retirement plan documentation. After review of the data form and previous retirement plan information, LAGERS sends the data form to Gabriel, Roeder, Smith & Co (GRS) for processing. It will take 4-6 weeks for GRS to complete the valuation. Once complete, LAGERS will send the valuation to the employer with instructions for completing the next steps in the process.

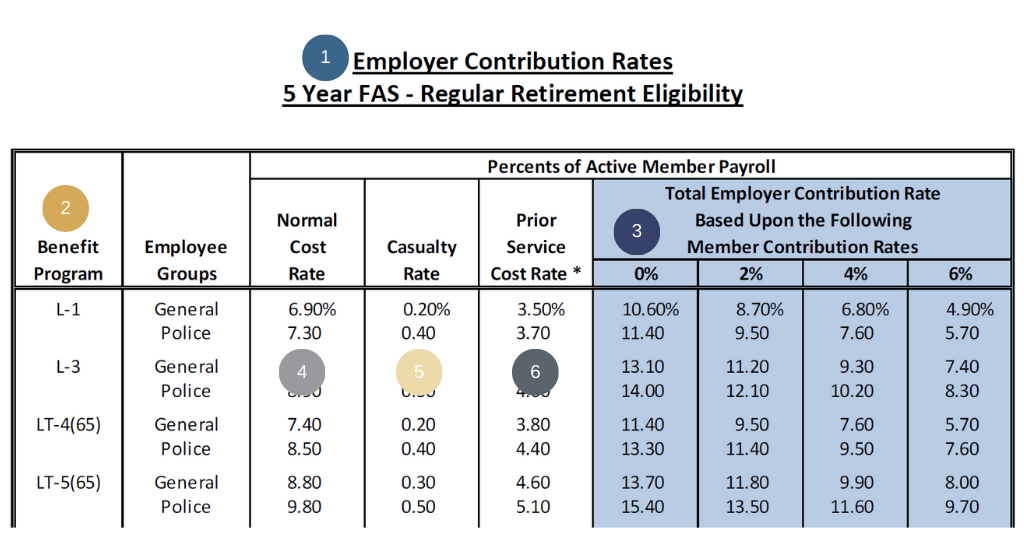

- Pages 4 – 7 have a similar layout, however, the difference between each page can be found below the “Employer Contribution Rates” title of each page. For example, the above illustration shows the cost of each benefit program with a 5-year final average salary and regular retirement eligibility.

- The benefit program column is listed from the least to the greatest program. Each benefit program has a corresponding benefit multiplier.

- Each blue column is the total employer contribution rate as a percentage of total gross payroll for the corresponding benefit elections. The first blue column includes no employee contributions, and for each column to the right, the employees’ contribution increases by 2% of total gross payroll.

- The Normal Cost Rate is the pre-funding assets for the employees’ current year of service. By design, this provides a mechanism for compiling assets in the trust prior to an employee’s retirement.

- The Casualty Rate is a pooled cost for duty-related death or disability benefits. In the event a duty-related disability benefit with extended service credit is payable, the assets necessary to fund the additional service credit are drawn from the pooled Casualty Reserve Fund.

- The Prior Service Cost Rate reflects the amortization of the employer’s initial unfunded actuarially accrued liability. The total liability amount is amortized over a 30-year closed period. The Prior Service Cost Rate is also where future benefit enhancement liabilities and actuarial gains or losses will be amortized.

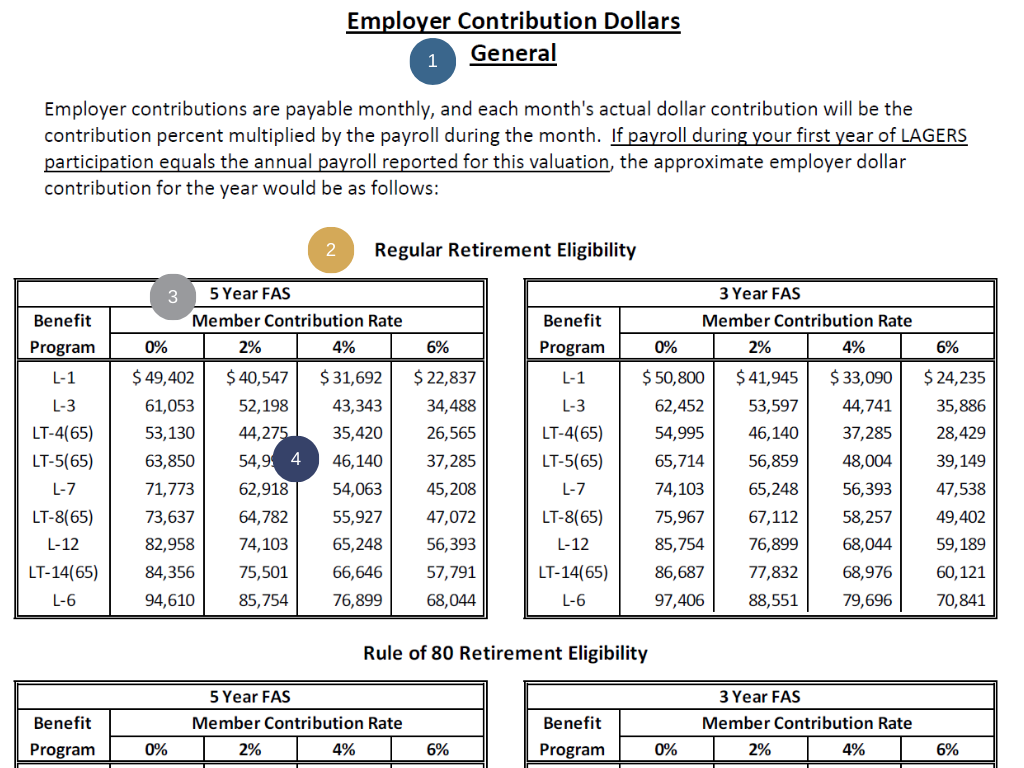

- The Employer Contribution Dollars section includes the projected annual dollar cost for each level of benefits. Each actuarial department has its own individual page.

- The top two tables reflect regular retirement eligibility. The bottom two tables reflect Rule 0f 80 retirement eligibility

- The tables on the left reflect a 5-Year Final Average Salary. The tables on the right reflect the 3-Year Final Average Salary.

- The total annual cost for each benefit program and with an employee contribution amount is displayed on the table.

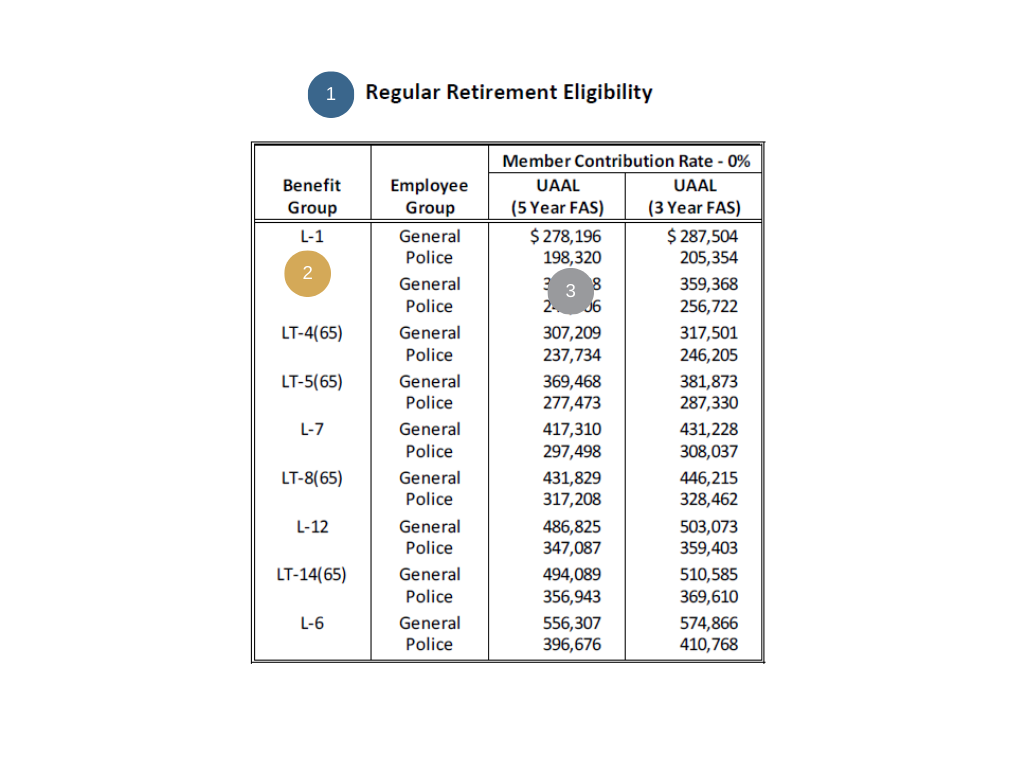

- Upon joining LAGERS, an employer will assume an unfunded actuarial accrued liability (UAAL). This liability is amortized over a 30-year closed period. The initial valuation includes the UAAL for each level of benefits on two separate pages. One page reflects regular retirement eligibility, and the second page reflects Rule of 80 retirement eligibility.

- Find the level of benefits the employer is considering adopting in the benefit group column

- Find the final average salary period with the corresponding benefit group to determine the employer’s UAAL upon joining

The UAAL is amortized over 30 years, and it is not due upon joining. However, an employer may choose to pre-fund all or a portion of the UAAL upon joining, if they desire. In addition, the UAAL amount and corresponding Prior Service Cost is reduced when an employer elects less than 100% prior service.