Your Member Annual Statement is one of the most important documents you receive each year from LAGERS.

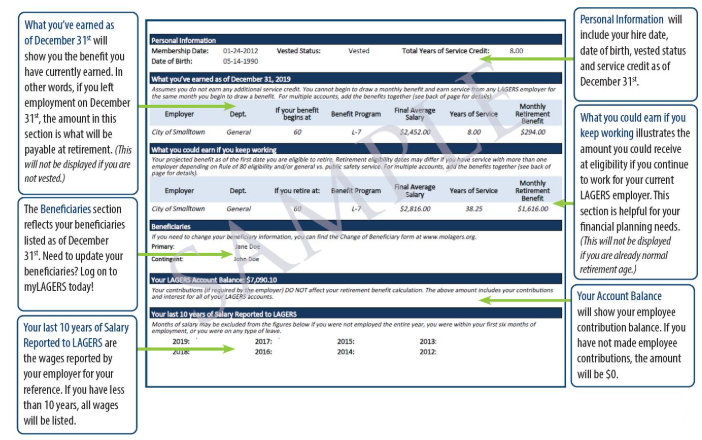

Mailed each March, your statement includes information such as your future earned benefit, your designated beneficiaries, your vested status, what you could earn if you keep working, your earnings record, and your member contribution balance.

When you receive your statement, it is important to review your benefit information and check for errors.

What you should review:

What you’ve earned as of Dec. 31, 2024. The amount shown in this section is the current value of your benefit if you were to have left your job at the end of 2024. The “What you’ve earned” section is good planning tool if you plan to leave public service soon and delay your benefit to a later date. This amount will be payable to you for the rest of your life once you reach eligibility.

Your designated beneficiaries. Keeping your beneficiaries up to date ensures that should LAGERS ever need to issue a refund of member contributions, we know who to pay them to. If your beneficiary(s) needs to be updated, use your myLAGERS account or download the paper form from molagers.org.

Your vested status. If you are vested, you are guaranteed to receive a benefit from LAGERS in retirement. To become vested, you must earn 60 months of service credit with a LAGERS covered employer. The other information within this section should be reviewed for accuracy.

What you could earn if you keep working. This is an estimate of your benefit if you work until you are eligible to draw your LAGERS benefit and is a great tool for knowing what else you need to save for retirement if you plan to continue in public service until the end of your career. This estimate does not include any future pay increases. If your earnings increase in the future, so will your future monthly benefit.

Your earning record. This shows the last 10 years of wages reported to LAGERS by your employer. It is important that this information is correct because your earnings directly impact your future benefit.

Your member contribution balance shows your member contributions. If your account balance is zero, it means that your employer covers 100% of your retirement contributions. Your benefit is NOT based on your member contribution balance; rather, this is the amount that would be refunded in the event no other benefit is payable.

What to do if you find an error:

If any information is incorrect on your Member Annual Statement, please contact your employer or the LAGERS office.

The Member Annual Statements are a tool for you to plan for your retirement goals. By taking the time to review your statement each year, you can prepare for a secure financial future.