LAGERS’ investment program is the cornerstone of ensuring secure and sustainable retirement benefits for Missouri’s local government workforce. Our members’ financial future depends on the careful stewardship of their contributions and their employer’s contributions. LAGERS’ disciplined investment strategy is designed to protect and grow these contributions over time to provide our members with peace of mind by delivering reliable retirement income while maintaining the long-term health of the system. By balancing growth and risk, we aim to safeguard our members’ financial future and sustain the system for generations to come.

Our philosophy is simple: don’t forecast, just listen. Unlike most institutional investment philosophies, which focus on valuations (value of assets), LAGERS believes valuations matter only at the extremes (the peaks and valleys in the market), with returns primarily determined by trends in the market, otherwise known as momentum.

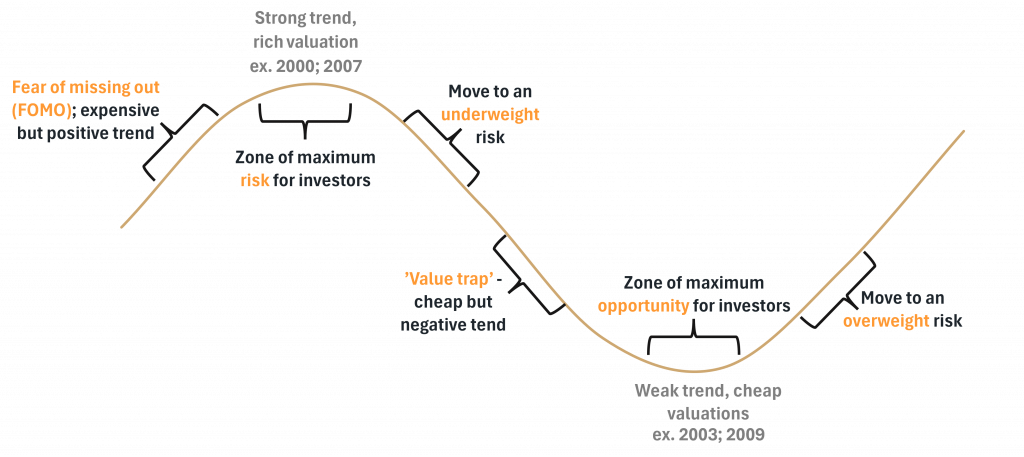

We establish our view on the current state of the market cycle based on the balance between current valuations (value of assets) and momentum (market trend). The sine wave below helps illustrate this cycle. This concept emphasizes the importance of a steady, long-term perspective and helps inform LAGERS’ decision-making within each of the various market cycle timeframes.

Over the past year or so, the market has been struggling between the continued march higher in equity prices versus the historically expensive valuations. Will the Mag 7 continue to lead the market higher? Will the election change the narrative? Will the Federal Reserve shift policy? All questions on investors’ minds. The good news is this is nothing new. Wall Street is said to “climb a wall of worry” with a seemingly new investment threat just around the corner of each market cycle. Our approach is not to forecast if these events will change the market direction. Rather, we view valuations and momentum in balance with each other.

Market trends, or momentum, generally tend to persist for longer periods of time until valuations reach an extreme. For example, 2000 and 2007 saw the end of great bull market as valuations reached extremes and “all the good news was priced in.” Conversely, the tech bubble crash of 2003 and the Great Financial Crisis of 2009, ended when valuations reached cheap enough levels that “all the bad news was priced in.” So, where are we today?

Since the COVID low in 2020, the equity market has been surging higher, with valuations reaching ever-higher peaks. The market has moved past the ‘FOMO’ stage and is now firmly in the same danger zone that saw the peaks in 2000 and 2007. But, as mentioned earlier, we do NOT forecast, and we do NOT know when the equity market will peak. It could be next week, next month, or next year. We don’t know, so our stance is to be neutral in risk allocation to equities. If they continue to march higher, the portfolio will produce similar market-based returns. If valuations finally priced in “all the good news,” the portfolio is in good shape to move toward an underweight risk position.

Investment Performance, net of fees, as of Sept. 30, 2024.

- One year: 11.2%

- Five year: 8.2%

- Ten year: 7.7%

- Twenty years: 8%