Elizabeth Althoff

One of the most brow-raising topics regarding members’ benefits is that of purchasing service. Yes, some members may be eligible to purchase additional service in LAGERS. And while not every member will have purchase-eligible time, for those that do, it can be a great way to add to your future retirement security.

Here are the top three questions I typically get when discussing purchasing service:

- What service can I purchase?

- How do I do begin the purchase process?

- How do I know if purchasing service is right for me?

Here’s my crash course on purchasing service in LAGERS. To begin, there are two different types of service that a member may be eligible to purchase. The first is military service, in which a member may purchase up to four years of active military duty to count towards service in their LAGERS benefit calculation. The second type is other Missouri public employment in which a vested member had previously worked for a non-Federal public employer in the state and either did not have a retirement plan with their employer, or did not become vested in the plan. A member may purchase up to the number of uncovered, full-time months they worked at that previous employer.

If you believe that you have service that meets one of these two definitions, the process to initiate a purchase is fairly simple. Complete the correct purchase form which requests cost information from LAGERS (Click here to find your form). The cost is unique to each member since it is based on factors such as your accrued credited service, salary, age, benefit program elected at your current employer, etc. After submitting this form, LAGERS will send you your specific cost information, and you will then have 60 days to decide if you would like to move forward (or not).

Now, I have to warn anyone looking into purchasing service. Many members experience ‘sticker shock’ when they receive their cost information. While the cost is different for everyone, it’s most likely going to be more than a couple hundred or even thousand dollars. Even with a steep price tag, however, the purchase may be a worthwhile investment.

Remember that purchasing service is converting a lump sum of money into guaranteed lifetime payments. So while the upfront cost may seem large, you have to think about the lifetime payoff of that investment when you are trying to figure out whether purchasing service is right for you. One way to estimate your payoff is to compare your annual benefit without the purchase to your annual benefit including the purchase. How do you do this? Log on to your myLAGERS account and use the “Benefit Calculator.” You can run two separate estimates, one normal estimate based on your desired date of retirement, and a second one with the added service you want to purchase.

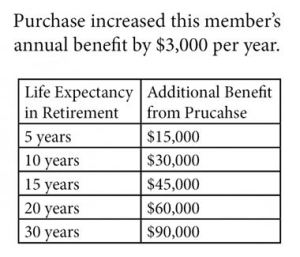

For example: Let’s say you run your two estimates, one with and one without the additional purchased service, and find that by purchasing service, your benefit would increase by $3,000 each year. And let’s say for this example the cost is going to be $30,000 to purchase those additional three years. That’s a big number, but remember that the purchase is going to increase the annual benefit by $3,000.

If you lived 20 years into retirement, that’s roughly an additional $60,000 (plus cost of living) that you’ve just added to your benefit. Think you’re going to make it 30 years? That’s an additional $90,000 over your retirement! On the other hand, remember that it’s important to be realistic about your expectations for retirement. If you are not sure you will enjoy as long of a life expectancy in retirement, you may find there would be better alternatives for your money. Keep in mind that the cost and the impact to your annual benefit will be unique, so it’s important to get on myLAGERS and create your own estimates to see what’s best for you!

There is no right or wrong answer when it comes to purchasing service, but if you are eligible, it certainly is worth a serious look to see if it makes sense for you and your future!

Other quick facts about purchasing service in LAGERS:

- You have to complete your purchase PRIOR to leaving LAGERS-covered employment.

- You may pay for the purchase with funds you roll from another retirement account or by monthly installments.

- The purchase amount is your money and is, along with any member contributions, always guaranteed to be returned back to you or a beneficiary.