Elizabeth Althoff

-1.jpg)

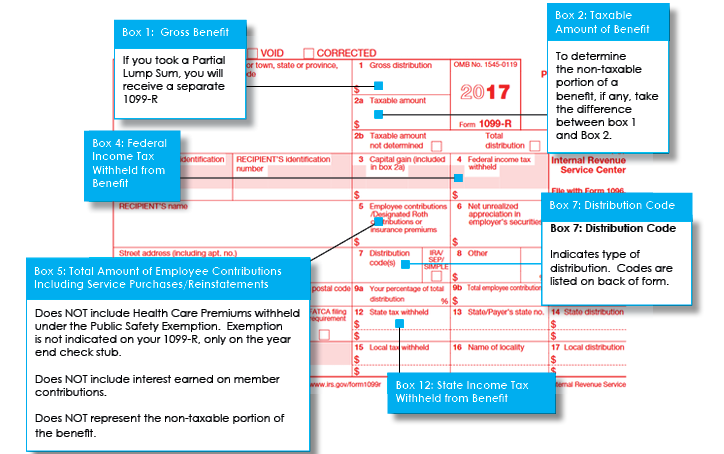

Now that your 1099-R has been mailed, and is also available for download from your myLAGERS account, you may be wondering what all those crazy boxes mean. Here is a simple summary of what’s in your 1099-R!

Box 1: This box contains your gross benefit amount. If you recently retired, and took a partial lump sum, you will receive a separate 1099-R for this distribution.

Box 2: Box two shows the taxable amount of your benefit. If you have after-tax member contribution in LAGERS, you can calculate your non-taxable portion by taking the difference between Box 1 and Box 2.

Box 4 and 12: These boxes shows the Federal and State Income Tax Withheld from your Benefit. Don’t forget that you can update your future tax withholding at any time on your myLAGERS account!

Box 5: This box shows the total amount of employee contributions you’ve made to LAGERS. This can include service purchases, but excludes any interest earned on your contributions in LAGERS. Because this box represents your total employee contributions, it does not change from year to year. This box does not represent the non-taxable portion of your benefit, and also does not include any Health Care Premiums you may have withheld under the Public Safety Exemption.

Box 7: Box 7 shows the distribution code, which are listed on the back of your 1099-R.

Although LAGERS staff is not qualified to provide individual tax advice, we encourage you to call our office if you have any specific questions about your 1099-R. You can also find more information about taxes and your LAGERS benefit on our website!