Angela Lechtenberg, APR

This year LAGERS retirees will receive a COLA (Cost of Living Adjustment) of around 1%. This increase will be reflected on October 1st and it means much more than just a slight increase to your monthly benefit. It shows the strength and overall financial security of your LAGERS pension system.

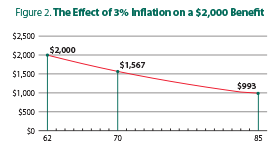

By now you know you’re rather fortunate to have a defined benefit pension plan as the foundation of your financial future. As a retired local government employee, LAGERS provides you with an exceptionally strong and secure pension plan. However, the added stability of your COLA is also something to be thankful for. More and more, we find other pension plans are not able to provide this to their retirees, ever, much less on a yearly basis, as LAGERS has historically been able to do. This means as time goes on; your benefit keeps pace with the economy and spending levels on goods and services, and won’t lose value every year.

“LAGERS cost of living adjustments are granted annually based upon the retirees date of retirement and applicable changes in the ‘consumer price index’ (CPI). Though this process may seem unnecessarily complex, I am extremely proud to share that 100% of LAGERS retirees have received increases equal to the CPI thereby maintaining 100% purchasing power in retirement,” says Keith Hughes, Executive Secretary.

Below are some things to understand about the benefit of having a COLA with your LAGERS benefit:

- It is based on inflation and the consumer price index and is designed to keep your benefit at 100% purchasing power.

- The LAGERS board meets annually to determine the COLA adjustment based on the financial solvency of the system. The COLA is not an automatic benefit, but don’t worry, LAGERS is fiscally sound and even though it isn’t automatic every year, LAGERS has historically been able to provide this to retirees consistently. In order to continue to keep benefits at a high level of strength and security for years to come the COLA will never be over 4% in a year. However, if the CPI is higher than 4% in any given year, this will be considered and additional increases will be given in future years to “catch up”.

- The LAGERS plan is exceedingly stronger than other plans of similar nature – Without going into the weeds on the specifics, just know that the fund we use only for paying our retirees’ benefits is slightly over 100% funded. Yes, you read that right. Overall, LAGERS is around 94% funded when the industry average for similar plans is around 73%. This means LAGERS is in a better position to meet all of our obligations to retirees for decades to come.

To give you a real life example of the power of having a COLA, the oldest of our members currently receiving a retirement benefit is 107. She retired in 1979 at the age of 70 and is currently receiving more than three times her original base benefit with accumulated COLA’s applied.

While this is obviously an extreme case, as we won’t all live to 107, it does show the significance of your COLA and how it affects your purchasing power in a positive fashion.

More good news, right? Keeping your benefit at pace with inflation is significant, especially when looked at over the lifetime of a retirement. So while the annual number may look insignificant, now you know that over time it matters much more than at first glance.

ALL retirees will receive a paystub in October showing your individual increase.