Jeff Pabst, CRC

.png)

Many people my age (mid 30s) can’t fathom what it’s going to be like in 30 years when we reach retirement. It’s a hard concept for us to understand because it is so far away from now. For some, you’re on the doorstep of retirement and others may be like me. Either way, we all need to understand the financial value LAGERS brings to our ability to achieve financial security in the future.

HOW LAGERS WORKS

As you may already know, LAGER is a defined benefit plan that is designed to provide you with secure monthly benefits reflective of your working career. All of LAGERS benefits are figured by multiplying your employer’s multiplier (1-2%), by how much you make by how long you work. The longer you work in a LAGERS covered position, the larger the benefit will be.

HOW MUCH WILL I GET?

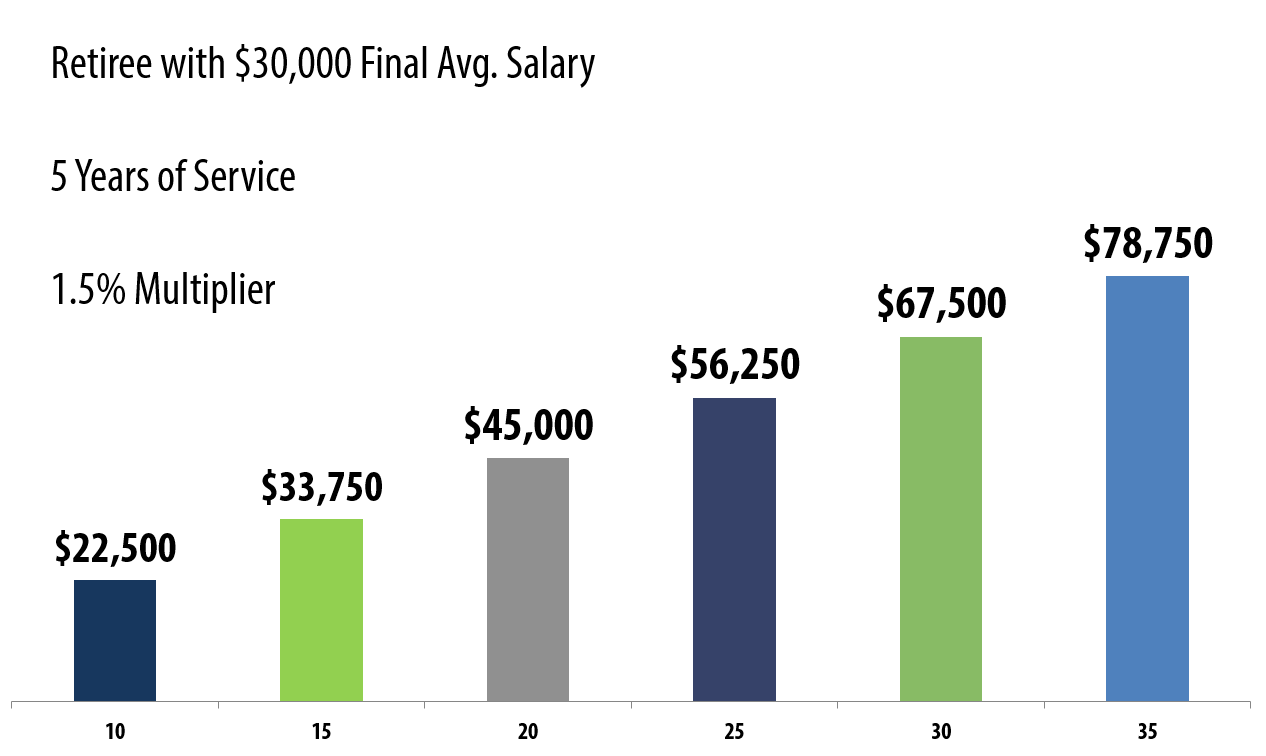

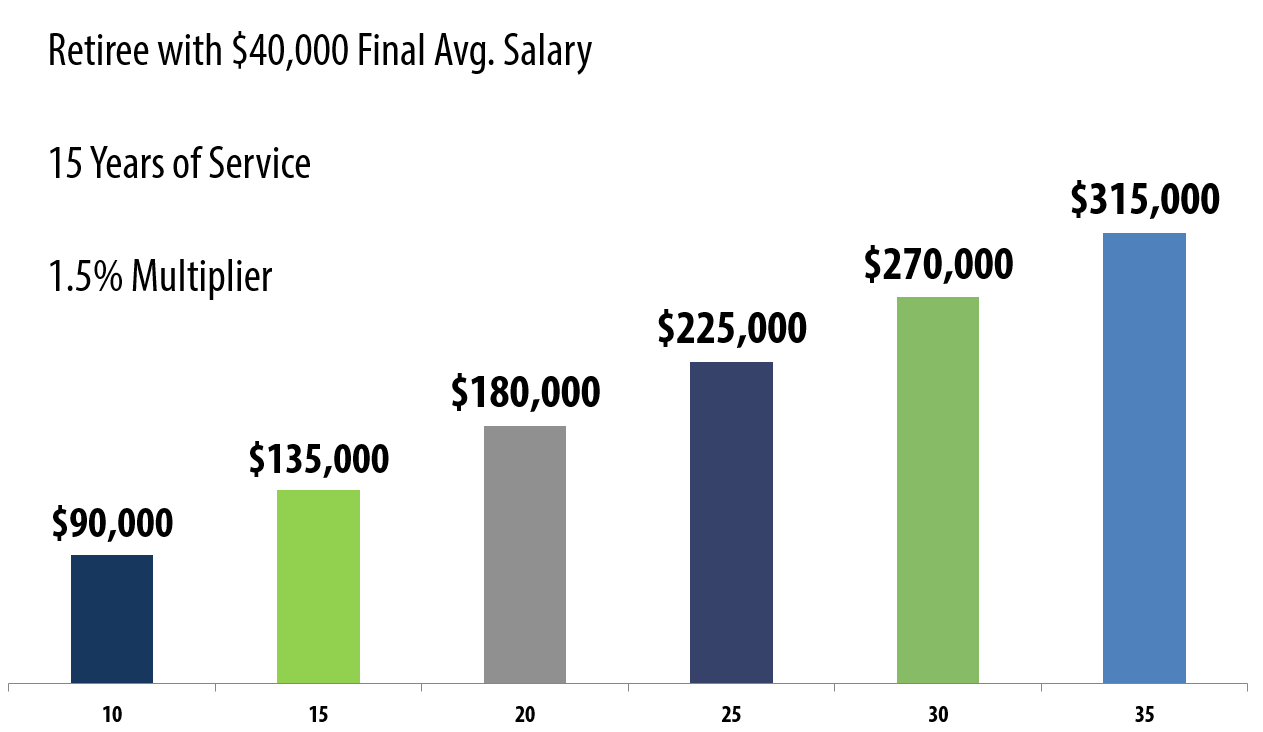

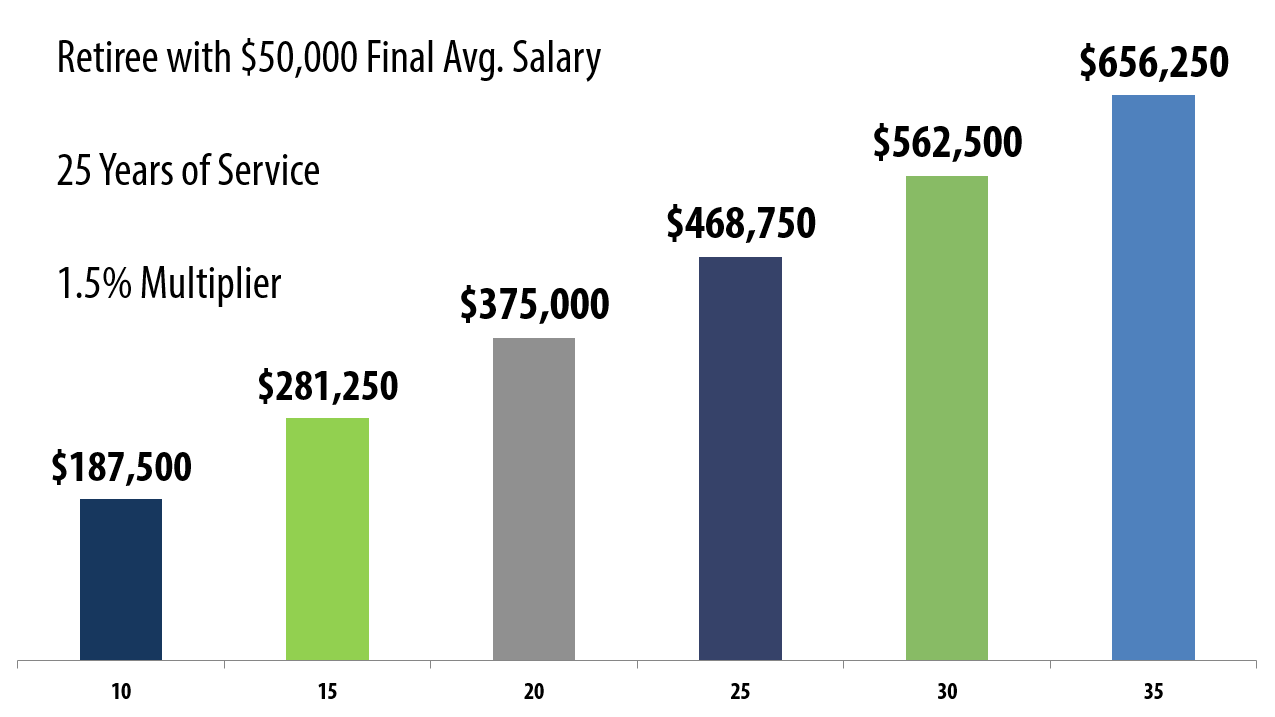

That all depends on how long you work in a LAGERS covered position. Below are some illustrations of how much you will receive in total for a 5 year career, 15 year career, and a 25 year career.

This is illustrating working up to your vesting point and leaving LAGERS covered employment. By doing so, you significantly limit the amount you receive from LAGERS in total.

At this point, you have added a significant amount of service and your salary increases during those 15 years. As you can see, the longer you work, the larger the benefit becomes.

If you choose to work your entire career in LAGERS covered public service, your total payout may look something like this (depending on your employer’s benefit elections). However, what’s more important is this is the amount you DID NOT have to save during your working years.

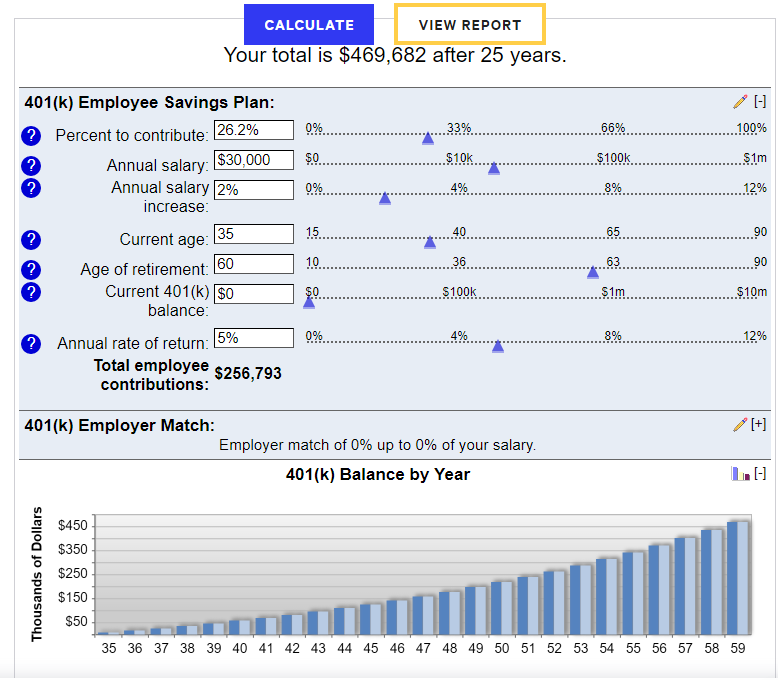

Without LAGERS: Saving on Your Own

Keep in mind, LAGERS is not designed to replace all of your income. In the above example, the LAGERS benefit is replacing 37.5% of the member’s pre-retirement income. If you were to work at your employer for 25 years, but didn’t have a defined benefit plan, you would have to save your income to ensure financial security. To replace just the amount provided in the above 25 year LAGERS benefit, you would need to save 26.2% each and every month you were working and never touch the money.

Your LAGERS benefit is a significant stabilizing force for your future financial security. The only thing you have to do to ensure you get this stable benefit is continue to work in public service covered by LAGERS. Continued work at your LAGERS employer with some savings, will give you financial independence when you leave the workforce.