Jeff Pabst, CRC

Achieving financial independence can seem overwhelming and, at times, unattainable. Rest assured, you can achieve financial independence with a secure source of income through your LAGERS benefit. As you may know, you’re LAGERS benefit will reward you for staying longer in public service. However, you may now know how to plan around your LAGERS benefit. This blog post will cover some of the basics about planning for financial independence with LAGERS.

Financial Planning With LAGERS

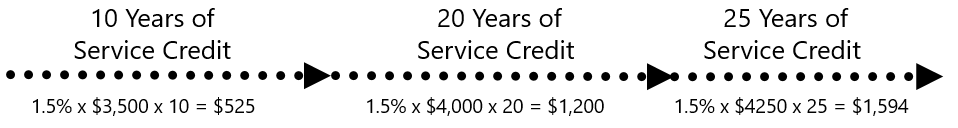

First and foremost, your LAGERS benefit is designed to replace your income. However, for it to be truly beneficial, you need to work a significant portion of your career for a LAGERS employer (or two), because LAGERS benefits are going to grow larger the more time you work for a LAGERS employer(s).

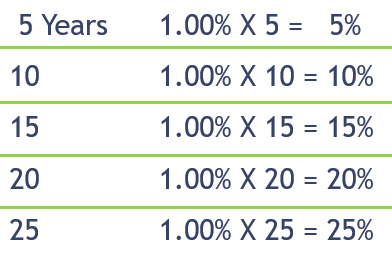

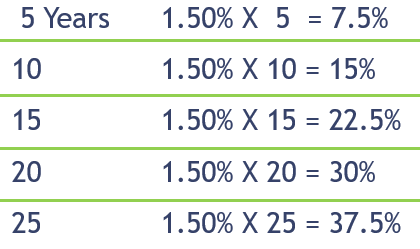

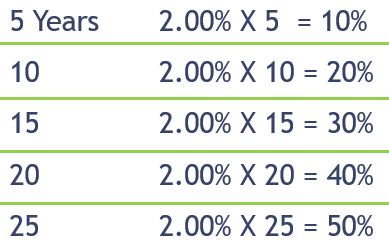

The illustration above shows you how to calculate the dollar amount of your benefit, but it does not include any method of planning with a LAGERS benefit. First you need to figure out how much of your income your LAGERS benefit will replace for you in the future. The best part about this method is it is just as simple as the calculation above, except we remove the salary component from it. So, if you have the 1.50% multiplier and work ten years for your employer, you will receive 15% (1.5% x 10 Years) of your average salary in lifetime monthly income from LAGERS. Below are some additional examples:

1.00% Multiplier Examples

1.50% Multiplier Examples

2.00% Multiplier Examples

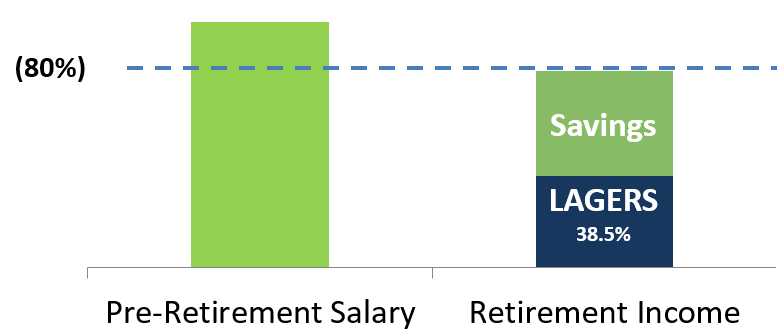

So, by determining how much will be replaced by LAGERS, we can now properly plan around it. Across the retirement industry many experts say to plan to replace around 80% of your pre-retirement income. If you have the 1.5% multiplier and work 25 years, you will receive 37.5% (1.5% x 25 years) of your pre-retirement income from LAGERS. If you’re going to reach 80%, you will need to replace 42.5% (80% – 37.5%) from other sources. Those other sources should include Social Security and Personal Savings. However, they can also include farm income, rental income, part-time income and others.

As you can see, LAGERS is not designed to replace all of your income, you will still need to save money or have other sources of income to achieve financial independence. However, it is part of your financial picture that is easily determined and will be there when you’re ready for your next chapter.