Jeff Pabst, CRC

It’s America Saves Week!

It’s America Saves Week!

This week is dedicated to instilling us with good savings principles. Last year, we showed you what some of our current savings goals were. Now that a year has passed, I thought it would be a good idea to review a few of our savings goals and discuss how we are doing to meet our goals.

I had the opportunity to speak with LAGERS Benefit Specialist, Dana Eichholz about her goal of saving for a new house and what she is doing to meet her goal. She told me, “We are trying to make extra principal payments on our current house each year to get it paid off quicker. We set a goal to have it paid off within the next couple of years. In the short term, we decided to forego some of our favorite hobbies. I have decided to pass on a few vacations (which is a bummer L) for the next few years and my husband has had to give up rebuilding tractors. Also, I have set up the use of automatic savings through our cafeteria plan that allow us to save some money on our daycare expenses.”

Also, I spoke with Dennise Schaben about her goal of saving for her husband’s retirement since he does not have a pension. She was delighted to say, “Saving for my husband’s retirement has been right on track. We have an IRA set-up for him and are having the monthly amount automatically withdrawn from our checking account. That way we don’t miss it or spend it on something else. We have a long way to go to meet our goal but we are confident we will achieve it.”

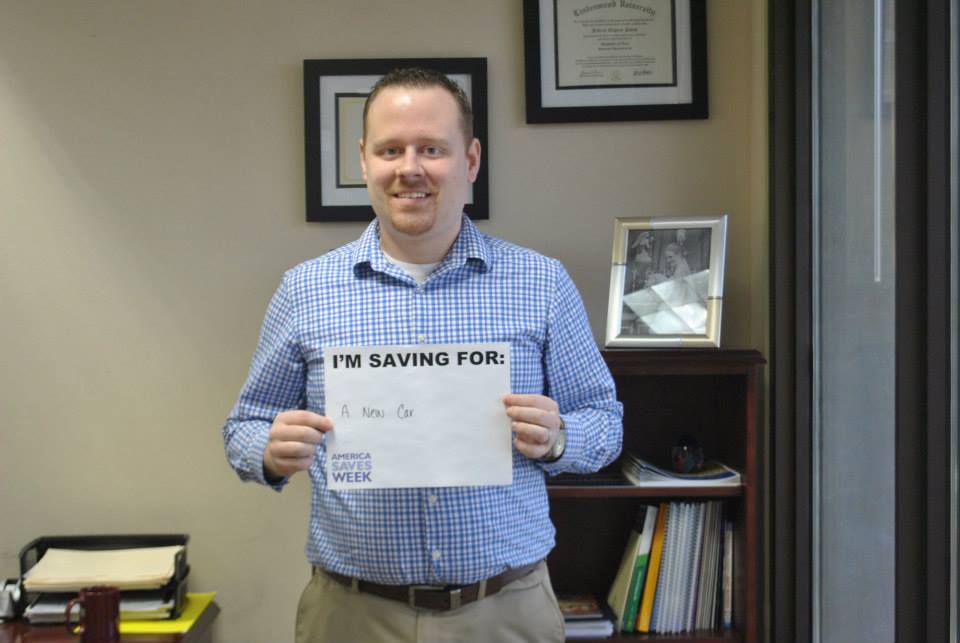

Finally, I thought I would do some reflection of my savings goal. At the time, I was saving for a new car because my wife and I were expecting our second child and I had a two door vehicle that would not be a very good fit with two kids. So, we decided that we were going to save for a new(er), bigger car. We started by setting up an automatic deposit into our savings account and I put my car up for sale. With the automatic savings and sale (instead of trade) of my old car, we were able to pay for 75% of a used minivan in cash.

Since I pulled the trigger on my previous goal, I now have a new, more medium term goal. My wife and I are looking to upgrade to a newer, larger home. As you may know, the more people (kids) you have, the more space you need! So, to do this, we have set up another automatic savings deposit and we are making more principal payments towards our current house (just like Dana J)

Savings goals can be difficult and you may have to give up some of the things you love to do to achieve your goals. However, the tools necessary to start saving are easy to access and not too difficult to implement. First set your goal, then come up with a plan for that goal, review the savings plan regularly, and make it easier on yourself by setting up automatic savings deposits.

Jeff Pabst, CRC Communication Specialist

Jeff Pabst, CRC Communication Specialist