Jeff Pabst, CRC

I have the pleasure of speaking with and educating many of our members across the state. One of the many things I hear from some of our younger members is, “I won’t ever get to quit working” or “It’s so far away, I can’t even think about it.” Some even hint that they will not be able to afford to ever quit working. But, the affordability of your future financial security and the amount of time in the future you have to save are directly related to one another.

The further away your need for drawing from your savings, the less you will need to save today to achieve financial independence. In other words, the longer amount of time you have to save and earn interest on your savings, the less you will have to save on a monthly basis. Below is a great video on the basics of savings and compound interest from 360financialliteracy.org.

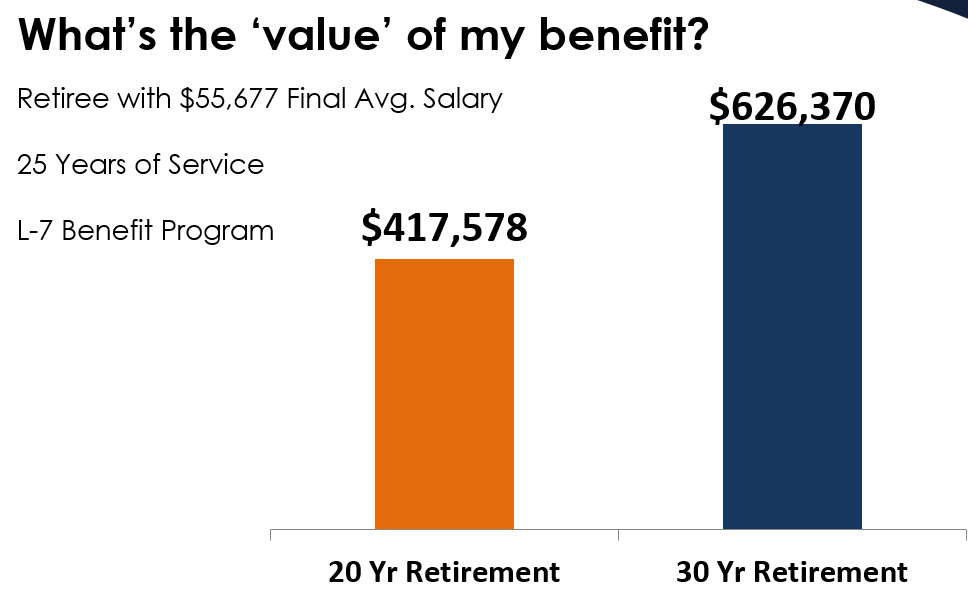

Another important piece of your financial puzzle is your LAGERS benefit. While saving to achieve financial independence is necessary, the amount you have to save in preparation of the future is significantly less because of your LAGERS benefit. The graphic below illustrates just how valuable your future LAGERS benefit will be for you if you choose to work your career with a LAGERS employer.

Keep in mind, this graphic illustrates someone who spends the lion’s share of their career in public service at a LAGERS employer. When leaving LAGERS covered employment, you may be leaving a significant amount of future financial security, as well.