LAGERS’ mission is to provide and preserve retirement security for those dedicated to serving Missouri’s local communities. One of the key plan features that helps you maintain financial security throughout your retirement is your benefit’s cost of living adjustment (COLA). The goal of your LAGERS’ COLA is to ensure your benefit keeps pace with the rising cost of goods and services. In other words, as the cost of groceries, gas, and other living expenses increase, so does your LAGERS benefit! While your living expenses are individual to your lifestyle, the LAGERS’ Board of Trustees uses a measurement called the Consumer Price Index (CPI) which measures the weighted average of inflation over time. Using this measure, LAGERS annually adjusts your benefit so that you maintain full purchasing power throughout your retirement.

THIS YEAR ALL ELIGIBLE RETIREES WILL RECEIVE A 4% ADJUSTMENT!

A Cost of Living Adjustment; Not a Raise.

One of the most common questions members ask is “what is the average cost of living adjustment LAGERS retirees receive each year?” This is a tricky question to answer because while we can historically look back at the average annual adjustment to retiree benefits, it doesn’t really tell us much about what retirees can expect (or should plan for) in the future. In fact, it would be a mistake to think of your cost of living adjustment as an annual raise you plan for each year. Your LAGERS’ COLA isn’t a raise because it’s not designed to just put more money in your pocket from year to year. Rather, it is meant to help the benefit you retire with maintain its purchasing power over a long period of time.

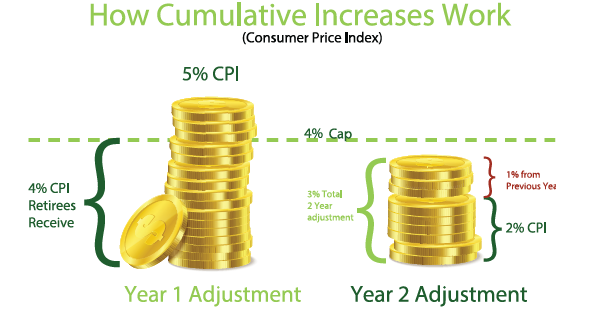

With that said, you may be wondering why this year’s increase is capped at 4% and how that impacts your long-term purchasing power. Although LAGERS is prohibited by law of granting more than a 4% increase in any one year, your COLAs are cumulative from year to year, and LAGERS will continue to adjust your benefit in the future until you are ‘caught up’ to 100% purchasing power.

Strong Funding = Preserved Retirement Security

LAGERS’ cost of living adjustments are granted at the discretion of the LAGERS’ Board of Trustees. Each year, the board

grants these adjustments while considering the long-term effects to the system’s funding. The good news is that your LAGERS system continues to be one of the best-funded pension plans in the country at 95.6% funded. LAGERS strong plan design and excellent funding has historically allowed the LAGERS Board of Trustees to grant cost of living adjustments every year, ensuring our retirees’ preserved financial security throughout their retirement!