Elizabeth Althoff

Did you know that every person living in Missouri benefits from the LAGERS system? How can that be, you might ask? While not every Missourian is actually drawing a benefit from LAGERS, the economic benefits produced by retirees spending their benefits, ripple throughout Missouri’s economy. This retiree spending produces major economic impact that affects each and every person living in our great state!

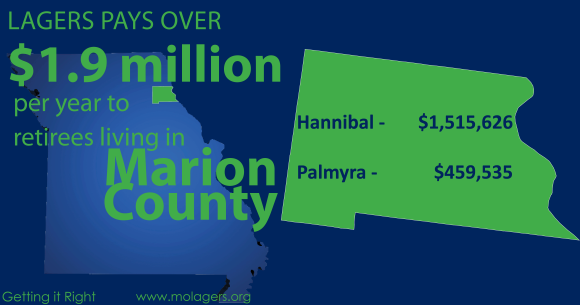

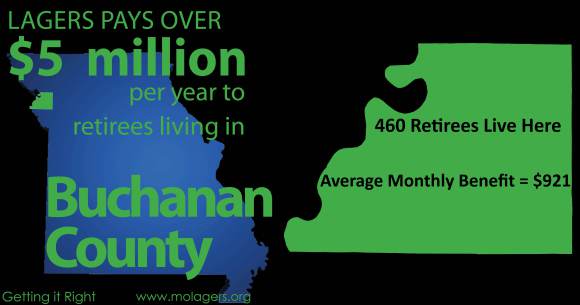

Here’s how: Each month, LAGERS pays out benefits to a retiree. These aren’t just any old benefits, mind you, these are benefits that were earned through often decades of public service; providing the necessary public services that keep our amazing local communities up and running every day. That retiree then takes that hard-earned benefit and SPENDS it! Approximately 91% of LAGERS retirees remain in Missouri, meaning a vast majority of LAGERS benefits are being spent right back into the local communities in which they were originally earned! In 2016 alone, that was to the tune of $244 million paid back into Missouri’s economy!

But the buck doesn’t stop there. Those retiree dollars keep on working, and the more retirees spend, the more local businesses can grow and further invest in their local economies. As local businesses boom, they hire more people, more businesses open their doors, all generating economic growth. In fact, according to the National Institute of Retirement Security, every $1 in state and local pension benefits paid in Missouri ultimately supported $1.41 in total economic output.

The impact of LAGERS’ retiree dollars is powerful and for many communities in Missouri can be an important economic lifeline. LAGERS is available to all local government units, big and small, in every corner of the state. The average LAGERS employer has fewer than 50 employees with many employing just 2 or 3. LAGERS provides the economies of scale and financial expertise that smaller employers can’t often access on their own. Furthermore, according to the Economic Policy Institute, high income families are 10 times more likely to have retirement saving than low income families. Having access to the LAGERS system helps ensure that all public servants regardless of where you live or how big your employer is have access to a secure retirement. And having a secure retirement means a big economic payoff for your community in retirement.

For more information on how pensions bring economic security to Missouri, visit our “A Guide to Pensions” page.

Elizabeth Althoff

Communications Specialist