Did you know that defined benefit plans, also known as pensions, are one of the most valuable assets a retiree has in their financial toolbox? Defined benefit plans, like LAGERS, allow retirees to reach financial security by guaranteeing a lifetime of monthly payments after retirement.

As a LAGERS member, you join thousands of local government employees across the state in a retirement system committed to providing the lifetime income you worked hard to earn.

How LAGERS Benefits Work

LAGERS will provide you with a guaranteed monthly payment, also known as a benefit, that reflects your salary and time worked in public service. Your benefit begins after you retire (and choose to start drawing a benefit) and will continue until your death, or, if you choose payment option A or B, the death of your beneficiary.

LAGERS retirement benefits are not tied to an account balance.

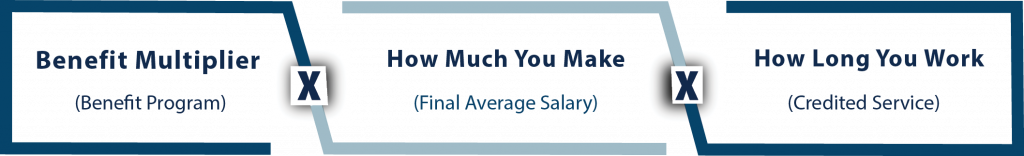

Instead, the amount of your monthly benefit is calculated using a formula with three factors: a benefit multiplier, how much you make (final average salary), and how long you worked (service credit).

This set formula is designed to provide predictable, secure income for life. A sample calculation might look like this: 1.5% × $5,000 × 25 years = $1,875 per month for life. This structure ensures that as your career and salary grow, so does your future benefit. Your monthly benefit is not affected by swings in the stock market and is protected without you having to make investment decisions. It will be payable every month for as long you live.

Benefit Multiplier

The first part of the benefit calculation is the benefit multiplier. The benefit multiplier is a percentage chosen by your employer ranging from 1% to 2.5%. The higher the multiplier, the larger your monthly benefit.

If you leave LAGERS-covered employment, your benefit program will freeze. Any new changes to your former employer’s LAGERS benefit program will not affect your future monthly payment.

How Much You Make (Final Average Salary)

The second part of your benefit calculation is your final average salary. Your employer selects whether this will be based on your highest consecutive 36 or 60 months of service credit. The higher your final average salary, the greater your monthly benefit.

If you’ve worked for more than one LAGERS-covered employer, your retirement benefit will be calculated separately for each employer. Service credit and benefit multipliers will be tracked individually by each employer you work for. However, LAGERS will use a single final average salary period based on your last 120 months of service credit regardless of which employer you worked for during that time.

How Long You Work (Service Credit)

The third part of your benefit calculation is your service credit, or the total time you’ve worked in a LAGERS-covered position. You become vested, or eligible for a benefit, in LAGERS after earning 60 months (five years) of service credit. Once vested, your benefit is guaranteed, even if you leave LAGERS-covered employment before retirement age.

Your service credit may include:

- Membership service: Time worked for a LAGERS-covered employer while the employer is participating in LAGERS.

- Prior service: Time worked before your employer joined LAGERS, if your employer elected to include it.

- Purchased service: Military or previous non-federal public employment in Missouri that you individually purchased with LAGERS.

What Age Can I Retire?

You are eligible to receive a benefit once you are vested and reach retirement age.

The normal retirement age is 60 for general employees, while police, fire, and public safety personnel (if elected) may retire at age 55. Additionally, some LAGERS employers offer a Rule of 80 provision, allowing you to retire earlier if your age plus years of service credit equals 80 or more.

Normal retirement ages:

- General employees: Age 60

- Police officers: Age 55

- Firefighters: Age 55

- Public safety personnel: Age 55 *This is an optional employer election. If your employer has not elected this option, EMS, emergency telecommunicators, and jailors are considered general employees.

A vested member is eligible to leave employment and receive a full, unreduced benefit at their normal retirement age.

If you choose to retire and begin drawing your benefit earlier than the normal retirement age, your monthly payment will be reduced by 6% for each year you are younger than your normal retirement age on a pro-rated basis. This equals a half percent reduction for each month you are younger than your normal retirement age.

Early retirement ages:

- General employees: Any age between 55-59

- Police officers: Any age between 50-54

- Firefighters: Any age between 50-54

- Public safety personnel: Any age between 50-54 *This is an optional employer election

Whether you’re just starting your career in public service or nearing retirement, LAGERS is here to provide the peace of mind that comes from knowing you’ll receive a dependable monthly income for life. By understanding how your benefit is calculated and when you’re eligible to retire, you can make confident decisions about your future.

For additional information or questions about your LAGERS benefit, visit molagers.org or call 1-800-447-4334.