Jeff Pabst, CRC

Have you turned on your television lately and heard an advertisement by a financial planning company? Your answer was more than likely a resounding YES! Retirement planning has become a huge business and industry. However, it has not always been this way. Let’s discuss where we came from and where we are now.

Prior to the 1930’s, retirement did not exist for the vast majority of Americans. For the most part, people just worked until they died or were physically unable. So, retirement is actually a relatively new phenomenon. In August of 1935 the Social Security Administration was created by the federal government. The idea was to allow people to leave the workforce death or disability.

Defined Benefit (DB) pension plans have been around since the times of the Revolutionary and Civil Wars. However, the majority defined benefit plans were established in the 1950’s and 1960’s. The primary purpose of defined benefit plans was to allow employees to leave the workforce in a dignified manner. And up until the late 1970’s, Social security and a pension were the means by which most of the population was able to retire.

In the 1980’s, Defined Contribution (DC) plans became increasingly popular. When defined contribution plans were established, they were intended to allow an employee to defer some income on a tax free basis for retirement purposes. The idea was that a defined contribution plan could supplement their retirement income they were already accruing with Social Security and their pension. However, the movement has changed in recent years to eliminating pensions and only providing a Defined Contribution Plan. But that may not be the best way to provide retirement security for Americans.

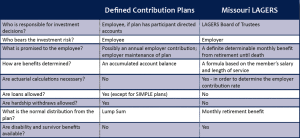

Below is a table illustrating the differences between a defined benefit plan, like Missouri LAGERS, and a defined contribution plan.

The movement to eliminate defined benefit pensions has created a retirement savings crisis across the nation. Many Americans are unable to leave the workforce in a dignified manner because they have not properly saved and their only other source of retirement income is Social Security. As of March 12, 2015, the median retirement account balance is only $2,500 (National Institute on Retirement Security)! Furthermore, the median retirement account balance for Americans nearing retirement age (55-64) is a mere $14,500 (National Institute on Retirement Security). This is hardly enough to draw from for a person’s retirement.

The original spirit of the defined contribution plans was to be a supplement to a person’s retirement income and not a person’s sole source of financial security. Currently, we are seeing what happens when a person has to rely on Social Security and a defined contribution plan. Americans believe they are going to have to work until they are unable to do so. Social Security, defined benefit plans, and defined contribution plans were intended to all work together to allow hard working Americans to leave the workforce with a little pride and a little dignity. Having all 3 sources of retirement income is the best and most efficient way to accomplish a secure retirement for all hard working Americans.