In June 2014, the Governmental Accounting Standards Board (GASB) issued pension accounting standards for public pension plans that require the plans and their sponsoring government agencies to report certain aspects of their pension for their financial reports. This reporting helps determine an employer’s future pension liabilities when participating in the LAGERS system.

When completing an audit, your organization’s auditor may want more information regarding your GASB requirements. As a LAGERS plan administrator, you may need to locate and disclose this information to your auditor.

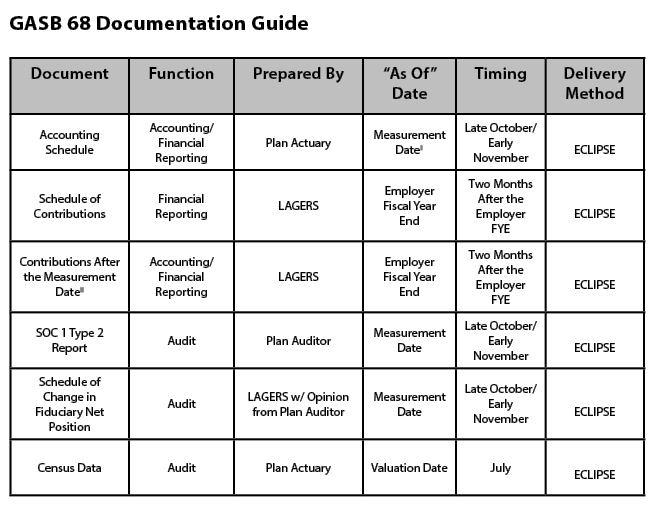

Below is a guide detailing the documents that may be requested.

For more information, visit molagers.org.