Sept. 9, 2024

The recent economic climate has been challenging for many retirees. Inflation, driven by a variety of factors including supply chain disruptions, increased consumer demand, and rising costs for goods and services, continues to impact consumers. For the average retiree, this means that everyday expenses like groceries, healthcare, and housing have become more expensive.

As retirees across the state continue to feel the squeeze of inflation, the value of having a Cost of Living Adjustment (COLA) as part of your LAGERS benefit feels more important than ever. LAGERS’ COLA is an annual adjustment designed to help your benefit keep pace with inflation. Without these adjustments, retirees on fixed incomes would struggle to keep up with the rising costs of living, potentially leading to a lower standard of living. COLAs provide a crucial financial cushion, helping to ensure that your retirement benefits remain adequate to meet your needs.

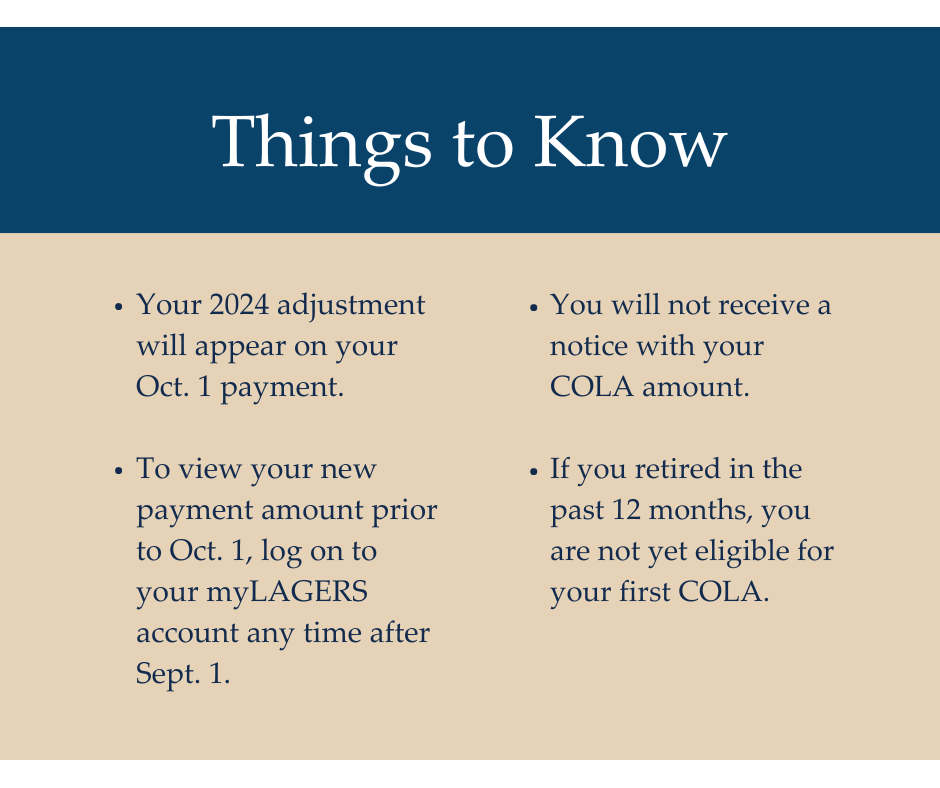

The LAGERS Board of Trustees has again approved a COLA for retirees in 2024. Cost of living amounts will vary by retiree depending on when you retired, but LAGERS’ goal is to ensure that all retirees are either at or working toward reaching 100% purchasing power of your original benefit. By law, an adjustment cannot exceed 4% in any given year. Because we have been in a period of unusually high inflation, this means some retirees may still be hitting the 4% annual cap as LAGERS continues to work every retiree back to full purchasing power.