Jeff Pabst, CRC

Traditionally, Black Friday is the beginning of the holiday shopping season. There are a number of steep discounts retail stores offer you and any savvy shopper would tell you are too good to pass up. Of course, it makes sense that you should try to spend less money on the same product you would have bought anyway. The same way it makes sense if you wanted to save the same amount of money in total by the time you retire, you want to pay less for it to accomplish your goal. Well, it’s possible if you begin saving at the right times.

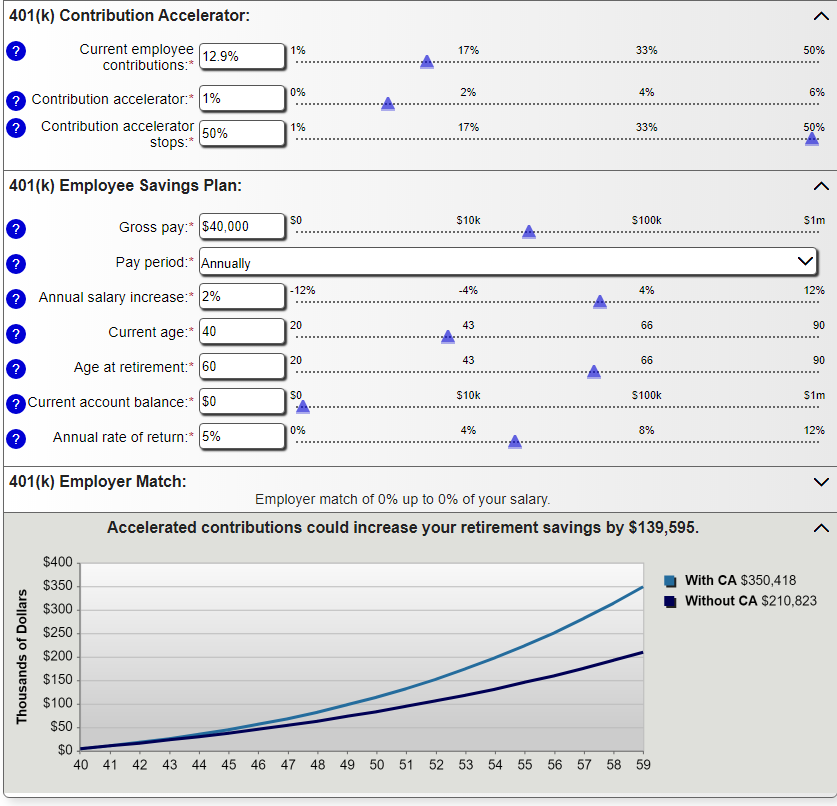

So, you’re newly hired at your employer and you have a LAGERS benefit that will help replace a significant portion of your income in retirement. You have determined that you need to save $350,000 in total by retirement to achieve financial security. But, maybe you’re like me with many things and you procrastinate about saving and wait until you are 40 years old to start saving. To be able to get close to your goal you would have to begin saving 12.9% of your salary and increase it by 1% per year until you reach retirement. (see below)

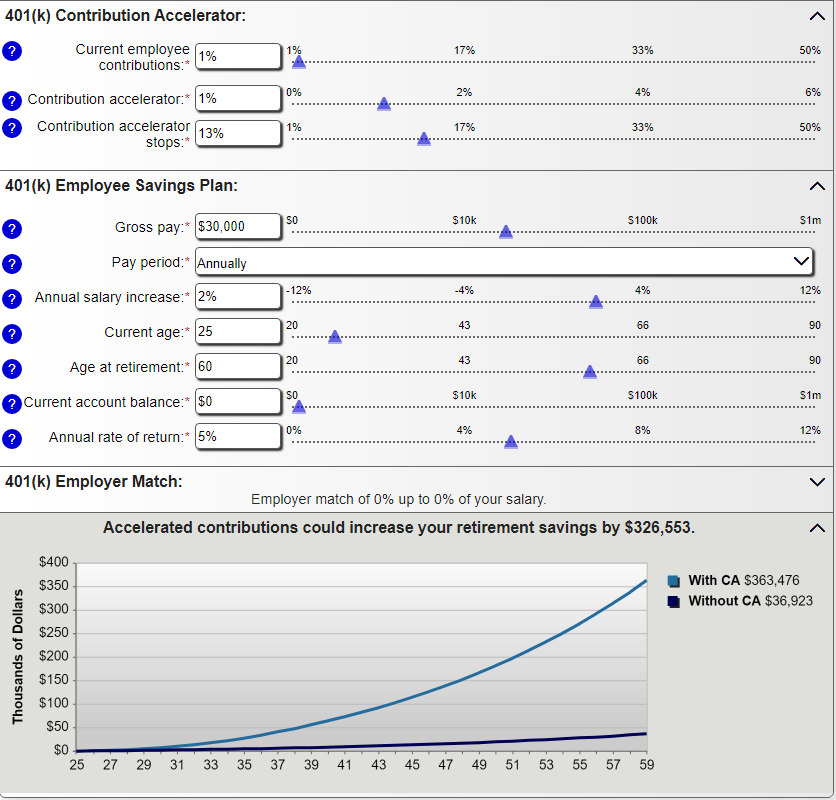

But, if you decide to begin saving at your hire date, age 25, you have a significant amount of additional time to accumulate enough assets to reach your goal. You could begin saving 1% of your pay at the beginning of your career and gradually increase it 1% per year for 13 years and continue saving for the remainder of your career, you will be able to attain your goal. (see below).

Calculation Credit: dinkytown.net

So, finding the most cost effective way to spend your money on your holiday gifts make perfect sense. So, does saving a lesser amount for a longer amount of time to achieve the same goal. Ultimately, with LAGERS, Social Security and your personal savings, financial independence is achievable and affordable.