Joan Jadali

For America Saves Week, we’re bringing back the story of the City of Webster Groves and how they found that a defined benefit pension plan was the best option for their employees to securely save for retirement. The City wanted to ensure that their employees had the best opportunity to achieve a secure retirement that could be provided. In turn, the employees benefited from the security of a defined benefit plan, and the City could remain competitive in order to recruit and retain the best crop of public servants for the community. Read Joan’s account of how they came to the conclusion that LAGERS provided the best value for the employees of Webster Groves.

In 2013, the City of Webster Groves joined the Missouri Local Government Employees Retirement System (LAGERS), a statewide public defined benefit retirement plan covering local government workers from all across Missouri. This is our story of why and how we made this giant leap forward in providing retirement benefits to our employees, and, we believe, in ultimately enhancing service to our citizens.

Background

In 1998, the City of Webster Groves converted from a defined benefit (DB) plan to a defined contribution (DC) plan for both non-uniformed and uniformed staff. The over-arching belief at the time was that defined contribution plans (think 401k) were better because employees could personally be rewarded with significantly high market returns in a time when stock market returns were in the range of 23% to 37% in the preceding three years.

However, when the markets plummeted in 2008, many DC plan participants lost at least a quarter of their investments initially. For those employees who were planning to retire within the next year or two, this drastically impacted their financial readiness for retirement. While employees were able to personally accumulate healthy account balances in the 1990’s, they were now were forced to deal with the fact that the market swings both ways.

Senior staff at the city decided to research other pension options available for city employees in 2009. A number of articles from professional journals were reviewed, many conversations with city staff were undertaken, as well as meetings and comprehensive discussions with professional consultants and advisers on both the DB and DC side of the platform.

Employees generally weren’t comfortable bearing the investment risk and responsibility of their individual plans even though they were offered the opportunity to meet quarterly, or more frequently if they requested, with investment advisers. Instead of taking the bull by the horns and researching the investment market, most employees tended to ignore their accounts all together.

Comparing DC and DB Plans

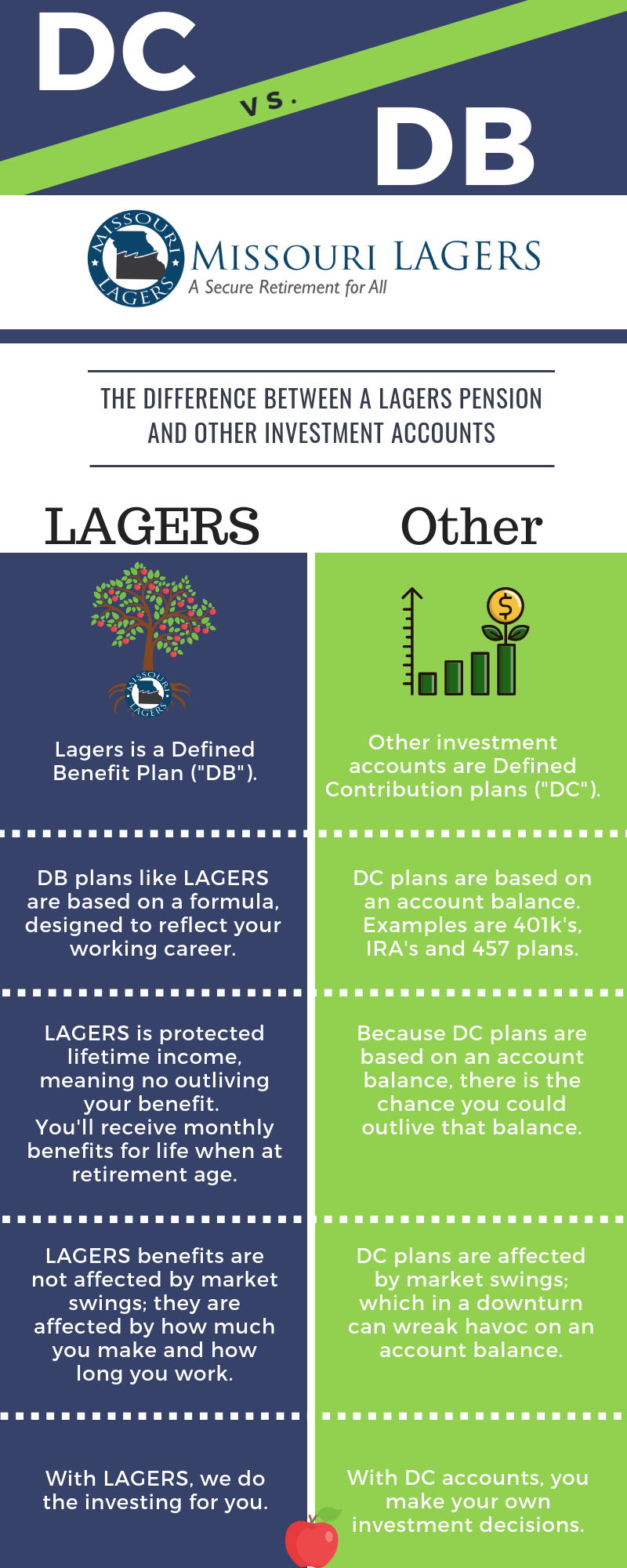

Our research led us to some key differences in the two types of plans, detailed as follows:

Benefits of DC Plan

Employee perspective:

- Access to funds before leaving employment under certain circumstances

- Benefits are portable with other retirement plans

Employer perspective:

- Investment risk is assumed by employee

- Benefits are portable (recruitment tool)

- Contributions are known and fixed

Challenges with DC Plan

Employee perspective:

- Adverse experience in employee investments can impact retirement outcomes

- No guarantee of a certain benefit level

Employer perspective:

- Adverse experience in employee investments can create delayed retirements

- Most competing public employers have DB plans

Benefits of DB Plan

Employee perspective:

- Steady stream of income during retirement

- Benefits are known and secure

- All investment-related risk is borne by the employer

- Cost of living adjustments to keep up with inflation

Employer perspective:

- More competitive with other competing public employers (recruitment tool)

- Allows dignified exit from the workforce

- Reduces delayed retirements

- Improves morale among employees

Challenges with DB Plan

Employee perspective

- May not be portable with other retirement plans

- Short-term employees may prefer a DC plan

- Employees with higher levels of education may prefer to direct their own investments

Employer perspective

- Require actuarial services; might be costly

- DB plan contributions are less predictable–based on many uncertain factors such as workforce demographics, mortality, return on investment, and inflation

Ultimately, we were looking for a solution that would more effectively serve our needs and better utilize our resources. We were looking to enhance employee performance and morale. We wanted to assist in providing future financial security for our employees and give them a track to security with a benefit structure that rewards them as service to our community increased.

Choosing LAGERS

The key attraction to LAGERS was their detailed, solid plan design and reputation for efficient administration. Also, the pooled disability and survivor benefits provided by LAGERS was extremely attractive for our employees. This was viewed as a great safety net for our younger employees. We did an extensive review of LAGERS and everything kept turning up positive. The knowledge, experience and expertise of the entire LAGERS administrative and investment team was so impressive.

Retirement system administration is so incredibly complex and requires very specialized skill. LAGERS represents over 700 separate employers across the state, with over 100 in the eastern (St. Louis) region alone. Assets under management are over $7 billion. Due to the asset size of the fund, investment opportunities are available that are not available to smaller investors, and lower fees for external investment managers can be more easily be negotiated. At the time we joined LAGERS, the plan’s funded ratio (assets compared to liabilities) was 86.5% (it now stands at 94.8% funded)—a very healthy plan position.

LAGERS’ plan design/funding mechanism is complex, well thought out and secure. The system annually reevaluates all required contributions and makes any adjustments to ensure full benefit funding. They have a number of detailed system safeguards (investment gain/loss smoothing, statutory limits on annual contribution rate increases, etc.) to lessen volatility in employer contribution rates.

Plus, all service with LAGERS-covered employers counts toward a member’s overall final retirement benefit, so not being in LAGERS was working against us in hiring. We knew our competing employers were successful in using LAGERS as a recruitment tool.

Click image to enlarge

The Process of Converting to LAGERS

In order to educate our employees and get their buy-in to the change, we had LAGERS staff present the plan to city staff at six different meeting times (in order to provide an opportunity to reach as many employees as possible).

After a short period of time following the last session, we asked employees to vote and 93% of employees voted in favor of joining LAGERS. We felt confident the employees were well-educated on the issue and made the right choice. The City council adopted a resolution to join LAGERS as of July 2013.

City employees were also provided an opportunity to rollover funds from the previous DC plan (and use any other personal funds they might have available) to purchase their prior city service and receive that service credit under LAGERS, which many employees did and continue to have the opportunity to do so.

Results

As a result of joining LAGERS, we’ve seen many positive results:

- Morale has increased. With increased morale comes increased productivity and better service to the community.

- We have added a significant recruiting tool which allows us to remain competitive in hiring into the future.

- Employees are generally retiring when they are eligible rather than continuing to work indefinitely due to the security of the lifetime benefit.

- The economic impact of benefits paid to retirees who continue to live in the community is significant—approximately $500,000 annually to those retirees residing in Webster Groves alone.

About a year ago the LAGERS team came to the city and interviewed several of our employees, as well as Mayor Gerry Welch, to inquire about our experience in switching from the DC plan to LAGERS. We all provided highly positive feedback and commentary, but perhaps Mayor Welch summed it up best for all of us when she said this…

“Here’s the bottom line in all of this. You can have a city where you have the most expensive, wonderful ambulance, snowplow and equipment possible. That doesn’t make any difference if you don’t have good, skilled employees who really care about the service that they provide.”

We feel confident that providing our employees with a secure means by which to retire when they are ready only further enhances the valuable services they provide to the community.